- Moving the markets

Yesterday’s calming speeches by 2 of the Fed’s mouthpieces (Bullard and Quarles) regarding inflation and interest rates are not only in the rear view mirror now but long forgotten as new Fed chair Powell took center stage and gave his first congressional testimony.

He focused on the strengthening economy with the result that traders immediately assumed that any improvements will be associated with more aggressive tightening of monetary policy. He elaborated as follows:

“We’ve seen continuing strength in the labor market. We’ve seen some data that will, in my case, add some confidence to my view that inflation is moving up to target. We’ve also seen continued strength around the globe, and we’ve seen fiscal policy become more stimulative.”

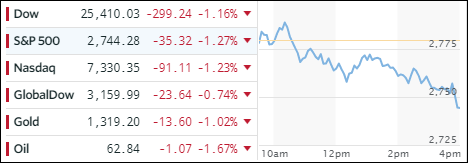

That was enough to send the major indexes into a tailspin thereby wiping out a good chunk of yesterday’s gains. It’s clear from the market reaction throughout this month that bulls and bears are engaged in a constant tug-of-war with interest rates (10-year bond yield +4 basis point to 2.90%), the short-term outcome of which can sway traders in either direction depending on who speaks and if the words used are hawkish or dovish.

Long-term the major trend remains up, as shown by our Trend Tracking Indexes (TTIs), but it appears that volatility is back on the table, which means that we may be stuck in zigzag mode for a while until the next breakout occurs.

- ETFs in the Spotlight

In case you missed the announcement and description of this section, you can read it here again.

It features 10 broadly diversified and sector ETFs from my HighVolume list as posted every Saturday. Furthermore, they are screened for the lowest MaxDD% number meaning they have been showing better resistance to temporary sell offs than all others over the past year.

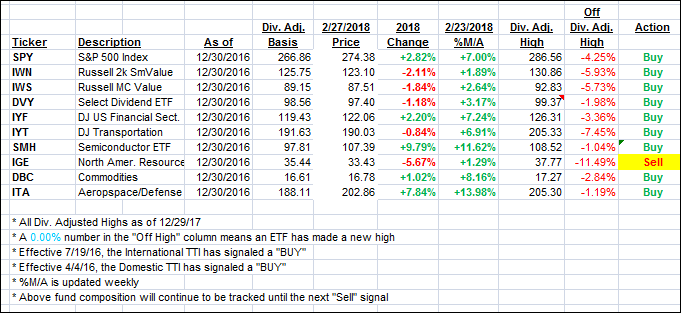

The below table simply demonstrates the magnitude with which some of the ETFs are fluctuating in regards to their positions above or below their respective individual trend lines (%M/A). A break below, represented by a negative number, shows weakness, while a break above, represented by a positive percentage, shows strength.

For hundreds of ETF choices, be sure to reference Thursday’s StatSheet.

Year to date, here’s how our candidates have fared so far:

Again, the %M/A column above shows the position of the various ETFs in relation to their respective long term trend lines, while the trailing sell stops are being tracked in the “Off High” column. The “Action” column will signal a “Sell” once the -7.5% point has been taken out in the “Off High” column.

- Trend Tracking Indexes (TTIs)

Our Trend Tracking Indexes (TTIs) slipped, as higher bond yields proved to be a hurdle too big to overcome.

Here’s how we closed 2/27/2018:

Domestic TTI: +3.21% above its M/A (last close +3.79%)—Buy signal effective 4/4/2016

International TTI: +3.67% above its M/A (last close +4.72%)—Buy signal effective 7/19/2016

Disclosure: I am obliged to inform you that I, as well as my advisory clients, own some of the ETFs listed in the above table. Furthermore, they do not represent a specific investment recommendation for you, they merely show which ETFs from the universe I track are falling within the guidelines specified.

Contact Ulli