ETF Tracker StatSheet

https://theetfbully.com/2017/10/weekly-statsheet-etf-tracker-newsletter-updated-10052017/

FINALLY BREAKING THE STREAK OF RECORDS

[Chart courtesy of MarketWatch.com]- Moving the Markets

It had to happen eventually. Any string of records will come to an end, and the major market indexes are no exception. It was a mixed bag though with Transportations experiencing its first down week in seven while the Dow notched its fourth up-week in a row. The S&P 500’s record streak came to an end, as the index slipped a tiny -0.11% but it was up solidly for the past 5 trading days.

Causing weakness in equities was the jobs report, which showed a contraction of 30,000 in nonfarm payrolls for September. Some of this was priced in due to the severe disruptions caused by Hurricanes Harvey and Irma. However, what was conveniently overlooked my MSM were the revisions. Look at this: July payroll employment was revised down from +189k to +138k, while August was revised up from +156k to +169k. Combined, it means that employment gains were 38k less than reported…

Of course, we know that markets and economic data are for the most part fabricated. Today, the BLS was caught manipulating wage data, which was nowhere reported either. If this subject interests you, please read the details here.

At the end of the day, equity ETFs suffered only small losses with Emerging Markets (SCHE) leading the pack lower with -0.40% followed by SmallCaps (SCHA) with -0.18%. Bucking the weakness were Semiconductors (SMH) with a gain of +0.40%.

Interest rates traded in a wide range and closed higher causing the 20-bond ETF (TLT) to lose -0.28%. Gold edged up, but Crude oil dropped another -2.91% not only below its $50 marker but also below its 200-day M/A. The whipping boy of the year, the US Dollar (UUP), also traded erratically but ended the day only -0.16% lower.

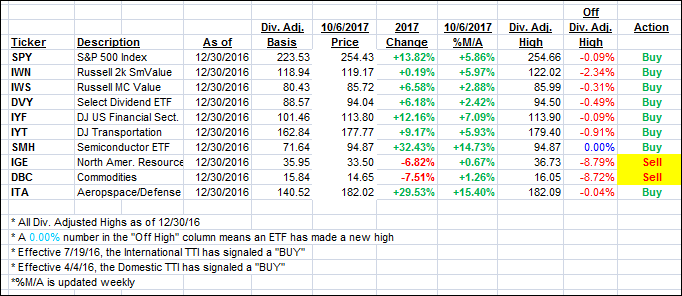

- ETFs in the Spotlight (updated for 2017)

In case you missed the announcement and description of this section, you can read it here again.

It features 10 broadly diversified and sector ETFs from my HighVolume list as posted every Saturday. Furthermore, they are screened for the lowest MaxDD% number meaning they have been showing better resistance to temporary sell offs than all others over the past year.

The below table simply demonstrates the magnitude with which some of the ETFs are fluctuating in regards to their positions above or below their respective individual trend lines (%M/A). A break below, represented by a negative number, shows weakness, while a break above, represented by a positive percentage, shows strength.

For hundreds of ETF choices, be sure to reference Thursday’s StatSheet.

Year to date, here’s how the 2017 candidates have fared so far:

Again, the %M/A column above shows the position of the various ETFs in relation to their respective long term trend lines, while the trailing sell stops are being tracked in the “Off High” column. The “Action” column will signal a “Sell” once the -7.5% point has been taken out in the “Off High” column.

- Trend Tracking Indexes (TTIs)

Our Trend Tracking Indexes (TTIs) moved slightly lower in part due to the weekly recalculation of the M/A.

Here’s how we closed 10/6/2017:

Domestic TTI: +3.09% (last close +3.27%)—Buy signal effective 4/4/2016

International TTI: +6.83% (last close +7.30%)—Buy signal effective 7/19/2016

Disclosure: I am obliged to inform you that I, as well as my advisory clients, own some of the ETFs listed in the above table. Furthermore, they do not represent a specific investment recommendation for you, they merely show which ETFs from the universe I track are falling within the guidelines specified.

————————————————————-

READER Q & A FOR THE WEEK

All Reader Q & A’s are listed at our web site!

Check it out at:

https://theetfbully.com/questions-answers/

———————————————————-

WOULD YOU LIKE TO HAVE YOUR INVESTMENTS PROFESSIONALLY MANAGED?

Do you have the time to follow our investment plans yourself? If you are a busy professional who would like to have his portfolio managed using our methodology, please contact me directly or get more details at:

https://theetfbully.com/personal-investment-management/

———————————————————

Back issues of the ETF/No Load Fund Tracker are available on the web at:

https://theetfbully.com/newsletter-archives/

Contact Ulli