- Moving the Markets

It was a mixed news bag as the housing recovery showed signs of “un-recovering” with Housing Starts dropping 2.6% in April after getting hammered in March with a 6.6% reduction. Not to be outdone, Building Permits joined in by tumbling 2.5% MoM, way below expectations.

On the retail side, the apocalypse continued as clothing retailer Rue21 filed for bankruptcy last night. Restructuring and streamlining is on the agenda translating to about 400 store closings (out of 1,179). Rating agency Fitch expects a flood of future defaults and has now eleven retailers on its concern list. Well, as I reported before, we are well on our way to the forecast 8,000 plus store closings for 2017.

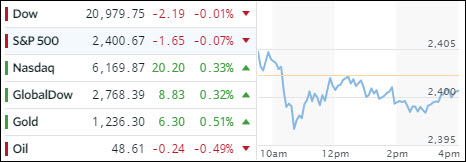

The US dollar has been slipping and sliding for 5 days in a row and has now erased all post-election gains. The question remains as to whether we will see another rebound after testing these lows for the 3rd time in the past 2 months, ever since Trump commented on the “too-strong dollar.” The beneficiary of this weakness has been gold, which has been rallying for 5 days in a row.

I keep talking about the low levels of the VIX (Volatility Index), which has market participants in a sleepy state of complacency as it supports the narrative that markets can only go one way—and that is up. The VIX set a new record by having closed 17 consecutive days in a row below 11, which has never happened before! That is unbelievable and certainly not sustainable.

- ETFs in the Spotlight (updated for 2017)

In case you missed the announcement and description of this section, you can read it here again.

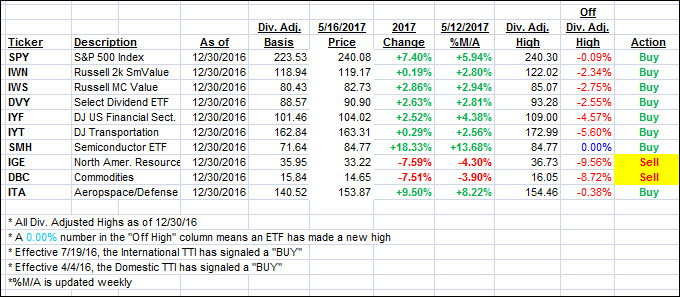

It features 10 broadly diversified and sector ETFs from my HighVolume list as posted every Saturday. Furthermore, they are screened for the lowest MaxDD% number meaning they have been showing better resistance to temporary sell offs than all others over the past year.

The below table simply demonstrates the magnitude with which some of the ETFs are fluctuating in regards to their positions above or below their respective individual trend lines (%M/A). A break below, represented by a negative number, shows weakness, while a break above, represented by a positive percentage, shows strength.

For hundreds of ETF choices, be sure to reference Thursday’s StatSheet.

Year to date, here’s how the 2017 candidates have fared so far:

Again, the %M/A column above shows the position of the various ETFs in relation to their respective long term trend lines, while the trailing sell stops are being tracked in the “Off High” column. The “Action” column will signal a “Sell” once the -7.5% point has been taken out in the “Off High” column.

- Trend Tracking Indexes (TTIs)

Our Trend Tracking Indexes (TTIs) marched deeper into bullish territory despite the major indexes closing mixed.

Here’s how we closed 5/16/2017:

Domestic TTI: +3.45% (last close +3.39%)—Buy signal effective 4/4/2016

International TTI: +8.64% (last close +8.20%)—Buy signal effective 7/19/2016

Disclosure: I am obliged to inform you that I, as well as my advisory clients, own some of the ETFs listed in the above table. Furthermore, they do not represent a specific investment recommendation for you, they merely show which ETFs from the universe I track are falling within the guidelines specified.

Contact Ulli