ETF/No Load Fund Tracker Newsletter For February 20, 2015

ETF/No Load Fund Tracker StatSheet

————————————————————-

THE LINK TO OUR CURRENT ETF/MUTUAL FUND STATSHEET IS:

————————————————————

Market Commentary

Friday, February 20, 2015

STOCKS ONCE AGAIN TIP THEIR HAT TO RECORD HIGHS

[Chart courtesy of MarketWatch.com]1. Moving the Markets

Stocks jumped Friday as the Dow and S&P 500 shot up to record closing highs on word that Greece and its eurozone creditors have officially reached an extension agreement on a debt deal. The Dow closed up more than 150 points, marking its first record close for 2015.

At a televised press conference in Brussels, it was announced that creditors will extend Greece’s bailout for four months, which is less than the six months Athens’ new government initially sought. But the deal, at least for now, means Greece will have cash to pay its bills and will remain in the Eurozone at this time.

In other geopolitical news, the Financial Times reported that NATO forces need to prepare for a major assault by Russia on an eastern European member state. Only time shall tell how that will impact markets in the near future.

In the week to come, numerous economic reports are expected. Reports include Q4 GDP on Friday. Fed Chair Janet Yellen will provide two days of testimony to Congress starting Tuesday, which will likely be closely watched for clues of future monetary policy decisions. In addition, both the consumer confidence and University of Michigan sentiment indicators will provide glimpses into the consumer’s current spending mindset. Other noteworthy reports expected include the S&P Case Shiller index of home prices, the consumer price index, and durable goods orders from January.

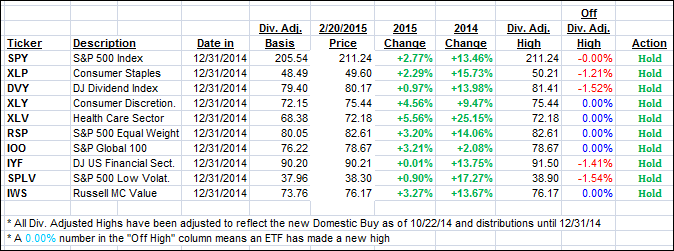

All our 10 ETFs in the Spotlight closed up with 5 of them making new highs; all 10 of them are now showing gains YTD as you can see in table 2.

2. ETFs in the Spotlight

In case you missed the announcement and description of this section, you can read it here again.

It features 10 broadly diversified ETFs from my HighVolume list as posted every Monday. Furthermore, they are screened for the lowest MaxDD% number meaning they have been showing better resistance to temporary sell offs than all others over the past year.

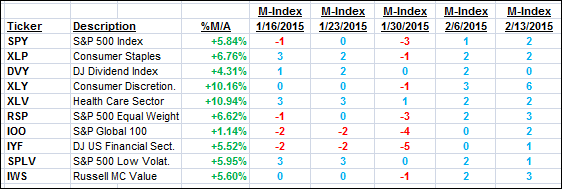

Here are the 10 candidates:

The above table simply demonstrates the magnitude with which some of the ETFs are fluctuating in regards to their positions above or below their respective individual trend lines (%M/A). A break below, represented by a negative number, shows weakness, while a break above, represented by a positive percentage, shows strength.

For hundreds of ETF/Mutual fund choices, be sure to reference Thursday’s StatSheet.

Year to date, here’s how the above candidates have fared so far:

Again, the first table above shows the position of the various ETFs in relation to their respective long term trend lines (%M/A), while the second one tracks their trailing sell stops in the “Off High” column. The “Action” column will signal a “Sell” once the -7.5% point has been taken out in the “Off High” column.

3. Trend Tracking Indexes (TTIs)

Our Trend Tracking Indexes (TTIs) followed the positive trend and closed up; especially the International TTI picked up some speed since last week’s Buy signal.

Here’s how this week ended:

Domestic TTI: +3.80% (last Friday +3.82%)—Buy signal effective 10/22/2014

International TTI: +3.79% (last Friday +2.46%)—Buy signal effective 2/13/2015

Have a nice weekend.

Ulli…

Disclosure: I am obliged to inform you that I, as well as advisory clients of mine, own some of these listed ETFs. Furthermore, they do not represent a specific investment recommendation for you, they merely show which ETFs from the universe I track are falling within the guidelines specified.

————————————————————-

READER Q & A FOR THE WEEK

All Reader Q & A’s are listed at our web site!

Check it out at:

http://www.successful-investment.com/q&a.php

Reader Freden:

Q: Ulli: With the international TTI going (and staying) positive over the last couple of days, would it be a good time to invest or ease into diversified international ETFs, such as VEU? Has enough upside momentum been demonstrated? Or, is this a potential head fake like last November?

A: Freden: As I said yesterday (2/12/15) in my commentary, barring any major sell-off this Friday morning (2/13/15), which did not occur, a new Buy signal for the international arena has been generated.

As with any other Buy signal, use my recommended incremental buying process depending on your risk tolerance and, of course, never forget to implement my sell stop discipline. With all that is going in Europe, things could reverse in a hurry. There is no one alive that could tell you whether this is another head-fake.

———————————————————-

WOULD YOU LIKE TO HAVE YOUR INVESTMENTS PROFESSIONALLY MANAGED?

Do you have the time to follow our investment plans yourself? If you are a busy professional who would like to have his portfolio managed using our methodology, please contact me directly or get more details at:

https://theetfbully.com/personal-investment-management/

———————————————————

Back issues of the ETF/No Load Fund Tracker are available on the web at:

https://theetfbully.com/newsletter-archives/

Contact Ulli