1. Moving the Markets

The stock market broke its three-day losing streak today, although markets are still looking fatigued since last Friday. The S&P 500 gained 0.77%, the Dow recouped 0.9% and the Nasdaq rose 1.03%.

Investors still seem to remain cautious about conflicts abroad in the U.K., Ukraine and Middle East, however, positive results that came in on the domestic housing markets were able to steer markets back into positive territory. New home sales surged 18% in August, which is a six-year high.

In the world of retail, we heard today that Wal-Mart (WMT) has announced it is now offering a service called “GoBank”. GoBank is a checking account service backed by Green Dot Bank.

GoBank accounts will have no overdraft allowance, minimum balance or monthly fees. GoBank will charge $8.95 a month for the services though. The best “free” checking account anyone could ask for! The stocks gained about 1.96%.

9 of our 10 ETFs in the Spotlight rallied with 1 of them making a new yearly high.

2. ETFs in the Spotlight

In case you missed the announcement and description of this section, you can read it here again.

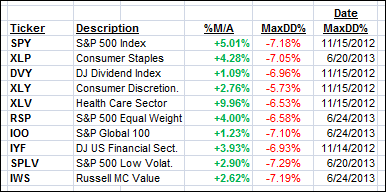

It features 10 broadly diversified ETFs from my HighVolume list as posted every Monday. Furthermore, they are screened for the lowest MaxDD% number meaning they have been showing better resistance to temporary sell offs than all others over the past year.

Here are the 10 candidates:

All of them are currently in “buy” mode, meaning their prices are above their respective long term trend lines by the percentage indicated (%M/A).

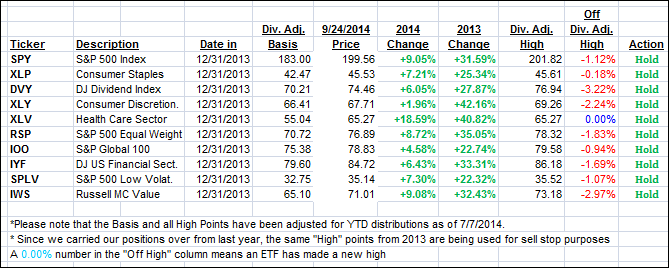

Year to date, here’s how the above candidates have fared so far:

To be clear, the first table above shows the position of the various ETFs in relation to their respective long term trend lines (%M/A), while the second one tracks their trailing sell stops in the “Off High” column. The “Action” column will signal a “Sell” once the -7.5% point is taken out in the “Off High” column.

3. Domestic Trend Tracking Indexes (TTIs)

Our Trend Tracking Indexes (TTIs) recovered and closed this rebound day as follows:

Domestic TTI: +2.03% (last close +1.65%)

International TTI: +0.65% (last close +0.23%)

Disclosure: I am obliged to inform you that I, as well as advisory clients of mine, own some of these listed ETFs. Furthermore, they do not represent a specific investment recommendation for you, they merely show which ETFs from the universe I track are falling within the guidelines specified.

Contact Ulli