1. Moving the Markets

Investors pushed markets higher as biotech shares helped counter somewhat disappointing retail sales numbers. The Commerce Department shared with us today that U.S. retail sales stalled during the month of July, which was the weakest numbers we have seen thus far in 2014. Amazingly, the major indexes rallied, as the chart above shows.

You may remember me pointing to upcoming retail sales numbers from groups such as Macy’s and Wal-Mart, as a window of insight as to the general growth of the economy. Well, Macy’s (M) quarterly earnings numbers missed analysts’ estimates, and the stock subsequently dropped 5.5%. Wal-Mart (WMT) will report on Thursday, and it will be interesting to see how markets react, given today’s disappointing retail sales numbers.

In Tech, Amazon (AMZN) gained 2.2% on the day after the company unveiled a $10 credit-card reader and mobile app that will move the company to a higher pedestal in the mobile payments market.

Let’s continue to keep an eye on international tensions abroad and those soon to be published earnings announcements.

Following the roller-coaster ride of the week, our 10 ETFs in the Spotlight now gained in unison for the day.

2. ETFs in the Spotlight

In case you missed the announcement and description of this section, you can read it here again.

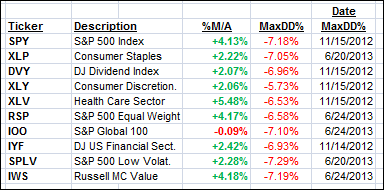

It features 10 broadly diversified ETFs from my HighVolume list as posted every Monday. Furthermore, they are screened for the lowest MaxDD% number meaning they have been showing better resistance to temporary sell offs than all others over the past year.

Here are the 10 candidates:

9 of them are in “buy” mode, meaning their prices are above their respective long term trend lines by the percentage indicated (%M/A).

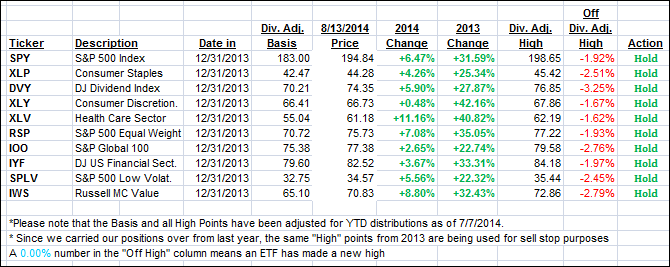

Year to date, here’s how the above candidates have fared so far:

To be clear, the first table above shows the position of the various ETFs in relation to their respective long term trend lines (%M/A), while the second one tracks their trailing sell stops in the “Off High” column. The “Action” column will signal a “Sell” once the -7.5% point is taken out in the “Off High” column.

3. Domestic Trend Tracking Indexes (TTIs)

Our Trend Tracking Indexes (TTIs) joined the bullish run and closed higher:

Domestic TTI: +2.07% (last close +1.63%)

International TTI: +1.05% (last close +0.66%)

Disclosure: I am obliged to inform you that I, as well as advisory clients of mine, own some of these listed ETFs. Furthermore, they do not represent a specific investment recommendation for you, they merely show which ETFs from the universe I track are falling within the guidelines specified.

Contact Ulli