1. Moving the Markets

Investors remained largely on the sidelines today, with sell-offs occurring throughout the markets in general. The S&P 500 barely gained 0.01%, the Nasdaq rose 0.05% and the Dow squeezed out a 0.08% gain.

Time Warner (TMX) reported Wednesday that its second quarter net income rose 10% to $850 million as the robust performance of HBO and its cable TV networks helped offset its film studio’s falling revenue. However, share prices fell 12% today to $74.24, continuing its slide from yesterday’s news announcement that Rupert Murdoch’s 21st Century Fox had withdrawn its bid to acquire the company.

After the closing bell, Keurig Green Mountain (GMCR) reported solid earnings that beat expectations and supported a bright forecast for the rest of the year. However, the stock dropped 4.5% in after-hours trading.

In emerging markets, emerging market stocks fell to a five-week low, continued to be driven lower amidst international concerns over the Ukraine and Russia conflict. President Vladimir Putin increased the number of troops on his country’s western border, Polish Prime Minister Donald Tusk told reporters today. We also heard reports today that Russia is going to block all U.S. agricultural imports into Russia.

6 of our 10 ETFs in the Spotlight managed to eke out a gain, while 4 slipped; no new highs were made.

2. ETFs in the Spotlight

In case you missed the announcement and description of this section, you can read it here again.

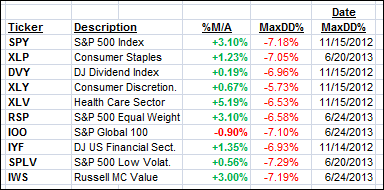

It features 10 broadly diversified ETFs from my HighVolume list as posted every Monday. Furthermore, they are screened for the lowest MaxDD% number meaning they have been showing better resistance to temporary sell offs than all others over the past year.

Here are the 10 candidates:

9 of them are in “buy” mode, meaning their prices are above their respective long term trend lines by the percentage indicated (%M/A).

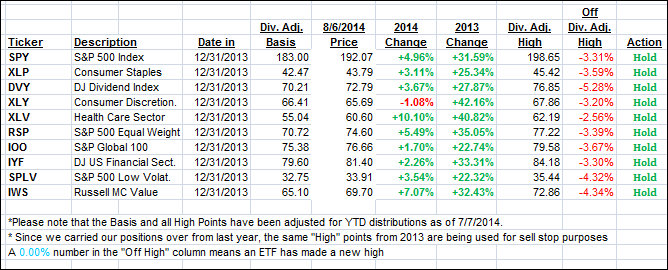

Year to date, here’s how the above candidates have fared so far:

To be clear, the first table above shows the position of the various ETFs in relation to their respective long term trend lines (%M/A), while the second one tracks their trailing sell stops in the “Off High” column. The “Action” column will signal a “Sell” once the -7.5% point is taken out in the “Off High” column.

3. Domestic Trend Tracking Indexes (TTIs)

Our Trend Tracking Indexes (TTIs) were mixed with the Domestic one gaining a tad while its Internationbal cousin slipped and headed closer towards its long-term trend line. Here’s how we ended up:

Domestic TTI: +1.27% (last close +1.21%)

International TTI: +0.51% (last close +0.70%)

Disclosure: I am obliged to inform you that I, as well as advisory clients of mine, own some of these listed ETFs. Furthermore, they do not represent a specific investment recommendation for you, they merely show which ETFs from the universe I track are falling within the guidelines specified.

Contact Ulli