1. Moving the Markets

Stocks closed lower with all 10 S&P 500 sectors losing. Energy was the biggest S&P 500 loser on the day, dropping 2.1%. Ukraine tensions were mostly to blame throughout headlines, as we heard today that Russian troops were massing near the Ukraine border.

Groupon Inc. (GRPN) fell 16% in after-hours trading. The daily deals site reported second-quarter revenue that fell short of analyst expectations. Also, its third-quarter projections for both earnings also disappointed.

21st Century Fox Inc. (FOX) withdrew its proposal to buy Time Warner (TWX) late Tuesday and pulled a 180 as it announced a share-buyback program instead. The move comes ahead of Time Warner earnings early Wednesday, when the media company is expected to report a profit of 84 cents per share on revenue of $6.88 billion. FOX gained 7.15% on the news, while TWX fell 9.85%.

Markets continue to be fragile in regards to international events, so let’s keep an eye on Ukraine, Gaza and the rest of the conflicts going on around the world.

Given today’s negative sentiment, it’s no surprise that our 10 ETFs in the Spotlight slipped with the indexes.

2. ETFs in the Spotlight

In case you missed the announcement and description of this section, you can read it here again.

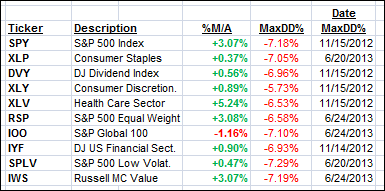

It features 10 broadly diversified ETFs from my HighVolume list as posted every Monday. Furthermore, they are screened for the lowest MaxDD% number meaning they have been showing better resistance to temporary sell offs than all others over the past year.

Here are the 10 candidates:

9 of them are in “buy” mode, meaning their prices are above their respective long term trend lines by the percentage indicated (%M/A).

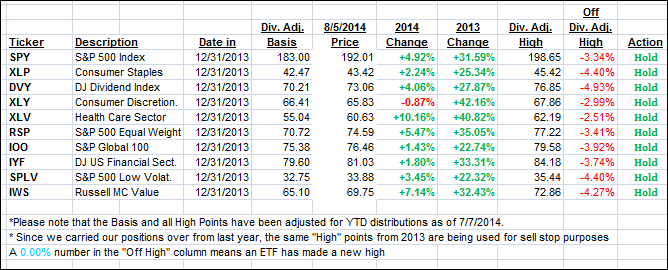

Year to date, here’s how the above candidates have fared so far:

To be clear, the first table above shows the position of the various ETFs in relation to their respective long term trend lines (%M/A), while the second one tracks their trailing sell stops in the “Off High” column. The “Action” column will signal a “Sell” once the -7.5% point is taken out in the “Off High” column.

3. Domestic Trend Tracking Indexes (TTIs)

Our Trend Tracking Indexes (TTIs) headed back south with the International TTI showing the most weakness; that has also shown up in the International ETF I track, namely IOO, which has now crossed its long-term trend line to the downside and into bearish territory (see %M/A in chart above). If weakness persists, I would expect the International TTI to become bearish first before its domestic cousin.

Here’s how we closed the day:

Domestic TTI: +1.21% (last close +1.61%)

International TTI: +0.70% (last close +1.39%)

Disclosure: I am obliged to inform you that I, as well as advisory clients of mine, own some of these listed ETFs. Furthermore, they do not represent a specific investment recommendation for you, they merely show which ETFs from the universe I track are falling within the guidelines specified.

Contact Ulli