1. Moving The Markets

Another big week of corporate earnings announcements is underway and markets reacted well to positive earnings announcements from companies such as Haliburton (HAL), Netflix (NFLX) and Hasbro (HAS). The S&P 500 gained 0.4% ending the day exactly where we started on April 1st. The continued climb of the markets over the past week is refreshing, needless to say, after a volatile start to the month, when a sell-off in high-flying technology and biotechnology stocks pushed the overall market lower.

Close to a third of the companies in the S&P 500 are scheduled to report Q1 earnings this week, which will give us a better picture on the state of the economy moving forward. McDonald’s (MCD), Delta Air Lines (DEL) and Apple (AAPL) are among the 159 companies in the S&P 500 that are scheduled to report. Together, the companies represent about a third of the value of the index. Of the 87 companies in the S&P 500 that had reported results through Monday morning, 62.1 percent have topped earnings expectations, according to Thomson Reuters data.

Nokia (NOK) said on Monday it expects the sale of its handset business to Microsoft (MSFT) to be finalized on April 25, as it had received all the required regulatory approvals. The closure of the 5.4 billion euro ($7.5 billion) deal, which was agreed in September, had been delayed due to pending approvals, but earlier this month the companies won a crucial nod from Chinese regulators.

Our 10 ETFs in the Spotlight gained with 2 of them making new highs today while 9 are in the green YTD.

2. ETFs in the Spotlight

In case you missed the announcement and description of this section, you can read it here again.

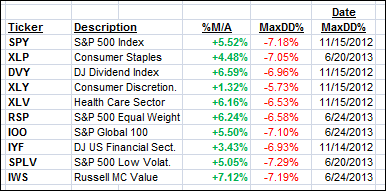

It features 10 broadly diversified ETFs from my HighVolume list as posted every Monday. Furthermore, they are screened for the lowest MaxDD% number meaning they have been showing better resistance to temporary sell offs than all others over the past year.

In other words, none of them ever triggered their 7.5% sell stop level during this time period, which included a variety of severe market pullbacks but no move into outright bear market territory.

Here are the 10 candidates:

All of them are in “buy” mode, with the exception of XLY, meaning their prices are above their respective long term trend lines by the percentage indicated (%M/A).

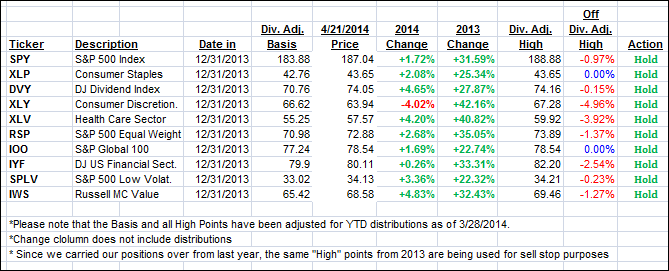

Year to date, here’s how the above candidates have fared so far:

To be clear, the first table above shows the position of the various ETFs in relation to their respective long term trend lines (%M/A), while the second one tracks their trailing sell stops in the “Off High” column. The “Action” column will signal a “Sell” once the -7.5% point is taken out in the “Off High” column.

3. Domestic Trend Tracking Indexes (TTIs)

Our Trend Tracking Indexes (TTIs) edged higher with the major indexes:

Domestic TTI: +2.48% (last close +2.26%)

International TTI: +3.41% (last close +3.20%)

Disclosure: I am obliged to inform you that I, as well as advisory clients of mine, own some of these listed ETFs. Furthermore, they do not represent a specific investment recommendation for you, they merely show which ETFs from the universe I track are falling within the guidelines specified.

Contact Ulli