1. Moving The Markets

The stock market had a “spring” in its step on the first day of spring. Signs that the U.S. economy is emerging from a winter slump drove major stock indexes higher today. Investors were encouraged by an increase in manufacturing and a rise in a key index of economic indicators. The S&P 500 came within a fraction of a point of wiping out all of its losses from a day earlier to finish the day up 0.6%.

The market had slumped yesterday, when Federal Reserve Chair Janet Yellen suggested that the central bank could start raising interest rates sooner than many investors had expected. How would interest rate hikes hurt our economy? Higher interest rates could hold companies back from borrowing to expand their businesses or discourage consumers from taking out loans such as mortgages, that’s how.

Microsoft (MSFT) was among the big gainers. The stock climbed 2.7 percent, after analysts at Morgan Stanley said a rumored plan to make a version of its Office software available for iPad devices could generate $1.2 billion in annual revenue. Guess (GES) slumped 3.4% after the apparel maker reported lower quarterly income and predicted a loss for the current period. And finally, ConAgra Foods (CAG) rose 1.4 percent, after the company said its latest quarterly earnings nearly doubled. It continues to benefit from the acquisition of private-label food maker Ralcorp.

Of course, we all know that the Crimea conflict has been at the top of the news banners all week. But, how will the sanctions placed on Russia impact financial markets? The Russian stock market has tanked 10 percent this month, wiping out billions in market capitalization.

Economists have slashed growth forecasts to zero this year and foreign investors have been pulling money out of Russian banks. Investors took $35 billion out of Russia in January and February – about half as much as in the entire preceding year. The EU’s gas market will likely suffer most from the sanctions against Russia, because it imports a third of its gas from Russia and has strong trades ties. It is also the world’s largest exporter of industrial metals, making exports from companies like Severstal crucial for global producers whether they are making cars or airplanes. Also, remember that European companies exported $170 billion to Russia in 2012. So if they were told to curb or stop their exports to Russia, they would suffer huge losses.

Our 10 ETFs in the Spotlight inched higher with 7 of them remaining on the plus side YTD while one of them made new highs for the year.

2. ETFs in the Spotlight

In case you missed the announcement and description of this section, you can read it here again.

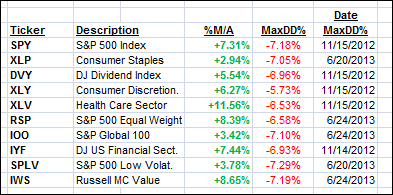

It features 10 broadly diversified ETFs from my HighVolume list as posted every Monday. Furthermore, they are screened for the lowest MaxDD% number meaning they have been showing better resistance to temporary sell offs than all others over the past year.

In other words, none of them ever triggered their 7.5% sell stop level during this time period, which included a variety of severe market pullbacks but no move into outright bear market territory.

Here are the 10 candidates:

All of them are in “buy” mode meaning their prices are above their respective long term trend lines by the percentage indicated (%M/A).

Year to date, here’s how the above candidates have fared so far:

To be clear, the first table above shows the position of the various ETFs in relation to their respective long term trend lines (%M/A), while the second one tracks their trailing sell stops in the “Off High” column.

3. Domestic Trend Tracking Indexes (TTIs)

Our Trend Tracking Indexes (TTIs) were mixed and closed as follows:

Domestic TTI: +3.65% (last close +3.50%)

International TTI: +3.50% (last close +3.65%)

Disclosure: I am obliged to inform you that I, as well as advisory clients of mine, own some of these listed ETFs. Furthermore, they do not represent a specific investment recommendation for you, they merely show which ETFs from the universe I track are falling within the guidelines specified.

Contact Ulli

Comments 2

I was surprised that commodity ETF’s, namely DBA, took a pretty big hit today. I also do not see any news coverage on this. Any idea what is going on? Especially following your previous call to “Get it While It’s Hot…. And Cheap”….

Alfred,

While there could be many reasons, one of them could be a normal pullback after a strong rally, which started in January of this year. Given that strong upmove, a less than 2% correction in this volatile sector does not seem out of line to me.

Ulli…