1. Moving The Markets

Overall, domestic and global markets performed well today. Here in the U.S., the S&P 500 climbed 0.6%, the Dow gained 0.7% and the Nasdaq composite rose 0.5%. A survey (from Markit) came in today that showed U.S. manufacturing expanded at the fastest pace in almost four years, which boosted investor confidence in the U.S. economy. The results from the U.S. survey contrasted with a survey of manufacturing in China, where manufacturing contracted for a second straight month in February. The contraction of manufacturing growth in China that was reported today also seemed to have an impact on oil prices, as prices fell to below $103 a barrel not long after the news. Oil prices did not drop too much though, because of the uncertainty that remains about protests in Venezuela, as well as export disruptions in Libya and South Sudan.

Tesla Motors jumped again today, 8.3% in fact, after the electric car maker delivered a strong fourth-quarter performance late Wednesday and said it expects the company’s vehicle sales to rise sharply this year. This stock has really been ‘zooming’ upwards over the past few months. It is up 30% YTD and up nearly 60% for the past 3 months despite valuation concerns that have been floating around recently.

Groupon Inc. (GRPN) fell in late trading after forecasting first-quarter profit that trailed analysts’ estimates on higher expenses for acquisitions and marketing. Online retailers generally struggled at the end of 2013. Amazon.com Inc.’s (AMZN) profit and sales trailed analyst estimates on a slowdown outside the U.S. and a surge in holiday shopping costs. EBay Inc.’s (EBAY) sales fell short of analyst estimates, and the company said in January that investor Carl Icahn had proposed splitting off its PayPal online-payments unit.

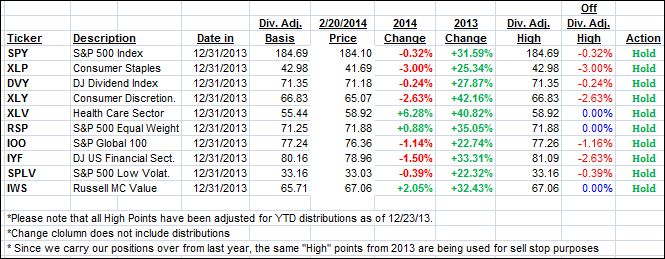

Our 10 ETFs in the Spotlight gained with the indexes, and 3 of them are in the green for the year.

2. ETFs in the Spotlight

In case you missed the announcement and description of this section, you can read it here again.

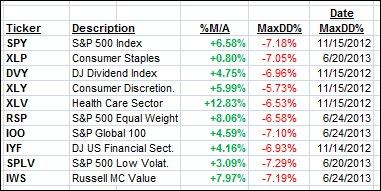

It features 10 broadly diversified ETFs from my HighVolume list as posted every Monday. Furthermore, they are screened for the lowest MaxDD% number meaning they have been showing better resistance to temporary sell offs than all others over the past year.

In other words, none of them ever triggered their 7.5% sell stop level during this time period, which included a variety of severe market pullbacks but no move into outright bear market territory.

Here are the 10 candidates:

All of them are in “buy” mode meaning their prices are above their respective long term trend lines by the percentage indicated (%M/A).

Year to date, here’s how the above candidates have fared so far:

To be clear, the first table above shows the position of the various ETFs in relation to their respective long term trend lines (%M/A), while the second one tracks their trailing sell stops in the “Off High” column.

3. Domestic Trend Tracking Indexes (TTIs)

Our Trend Tracking Indexes (TTIs) inched higher and remain firmly entrenched on the bullish side of their respective trend lines:

Domestic TTI: +3.64% (last close +3.41%)

International TTI: +6.08% (last close +5.87%)

Disclosure: I am obliged to inform you that I, as well as advisory clients of mine, own some of these listed ETFs. Furthermore, they do not represent a specific investment recommendation for you, they merely show which ETFs from the universe I track are falling within the guidelines specified.

Contact Ulli