The ETF/No Load Fund Tracker

Monthly Review—November 30, 2013

US Equities Finish November On A High; Europe Sputters

US equities continued their bull run in November with all the three major indexes finishing higher for the month. The Dow Jones Industrial Average and the S&P 500 remained comfortably above their milestone levels of 16,000 and 1,800, respectively, and marked their eighth straight week of advances.

The Dow finished at 16,086.41, up 3.5 percent for November. The S&P 500 closed out at 1,805.81, higher 2.8 percent for the month.

The tech-heavy NASDAQ Composite index climbed 3.6 percent for the month to finish at 4,059.89.

The FOMC minutes from the Fed’s October meeting suggested the central bank could slow the pace of its asset purchases if the labor market showed persistent improvement, causing small hiccups in equities. The markets, however, showed remarkable resilience and recovered quickly, possibly realizing the Fed minutes really didn’t tell anything that the markets didn’t already know. Also, traders seemed to warming up to the Fed’s articulation that a tapering isn’t a tightening, and the Fed funds rate is apt to stay near the zero mark even well after the central bank ends its monthly bond buying program.

Another critical development related to the Fed for the month was the near certainty of Janet Yellen’s confirmation as the next Fed chairman following her appearance before the Senate Banking Committee. The change in leadership is likely to be smooth next year as Fed chairman Ben Bernanke and Yellen seem to be on the same page about the health of the economy.

On the economic data front, consumer sentiment and labor market readings indicated a slow but steady economic recovery. The final November reading of the consumer sentiment index came in at 75.1, bettering October’s reading of 73.2 even as consumers remained skeptical about the congressional deadline for reaching a settlement on the federal budget and debt ceiling.

Separately, a report by the Labor Department showed jobless claims fell by 10,000 to 316,000 in the week ended Nov 23. Economists had called for a rise to 330,000 on a seasonally adjusted basis.

Orders for durable goods fell by 2 percent in October, suggesting weakness in business investments, the Commerce Department said on Nov 27. The lack of bookings for commercial and military jets in the more volatile transportation sector hit October readings.

Orders for durable goods have increased by 4.8 percent in the first 10-months of 2013 while core orders have grown by a lackluster 4.1 percent, the October report said.

Among other economic developments, wholesale inventories ticked up 0.4 percent in September after an upwardly revised 0.8 percent gain in August.

Export prices, excluding agriculture, fell 0.4 percent in October following a 0.3 percent gain in the previous month. Import prices remained unchanged following September’s uptick of 0.2 percent.

Across the Atlantic, European stocks tracked their US counterparts. The Stoxx Europe 600 index closed at 325.16, up 0.9 percent for the month. The pan-European index is up 16.3 percent year to date.

The German DAX 30 index led the region’s advance in November, adding 4.1 percent for the month. Both the French CAC 40 and British FTSE 100 index shed 1.2 percent in November.

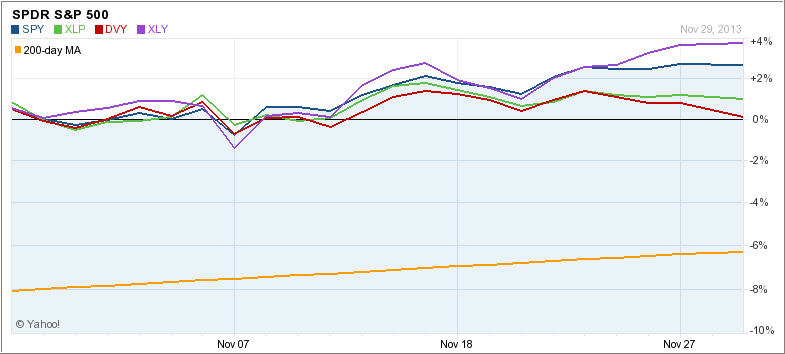

Our major holdings meandered with the markets with XLY taking the lead followed by SPY. DVY dragged as it gained only slightly while XLP slowed down from the torrid pace it set in October. Take a look at the chart:

Our main directional indicator, the Domestic Trend Tracking Index (TTI) kept pace with the major indexes and remains solidly on the bullish side of the trend line, as the chart shows:

November turned out to be another good month for those of us invested in equities. It almost seems to be a surreal market environment, which is not surprising given the fact the Fed has determined market direction ever since its introduction of the various stimulus programs.

Surely, there will have to be some kind of pullback in the near future if for other reason than profit taking and/or some sense of reality creeping in. This is also the time when you will hear latest proclamations and estimates as to how high these markets will go next year. Goldman Sachs was the first one in stating that the S&P 500 will fall by 10% over the next 12 months before rallying to the 1,900 level by year end 2014. Then it’s on to 2,100 by the end of 2015 and 2,200 by the end of 2016.

Of course, this is all guesswork and it behooves you to pay no attention. We have our trailing sell stops indentified and will execute them when necessary in accordance with our exit strategy.

Contact Ulli