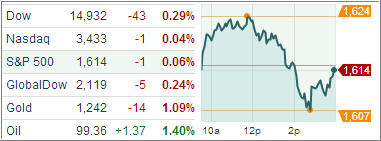

U.S. equity ETFs edged lower erasing earlier gains despite upbeat domestic auto sales figures for June and a stronger-than-forecasted report on factory orders. Selling pressure was fueled in-part by the escalating political turmoil in Egypt along with euro weakness after reports indicated the International Monetary Fund and Eurozone officials gave Greece three days to prove its reforms are on course. The S&P 500 met resistance around its 50-day moving average again; a level the index has not been able to close above for the past two weeks.

Major U.S. stock indexes traded higher until early afternoon, boosted by positive car sales and factory orders, which rose 2.1% in May, its third increase in the past four months, and above the consensus of 2.0%. Nondurable goods orders moved up 0.7%. On a y/y trend basis, factory orders growth has been anemic for months, but has stabilized around 1.0%, led by durables.

Stocks retreated from their highs in the afternoon amid headlines from Egypt and Europe. The news took some wind out the market’s sails and pressured the euro below 1.30, to a one-month low against the dollar. Today’s dollar strength did not slow the advance in crude oil.

Among the S&P 500’s 10 sectors, the energy sector rose 0.2 percent after crude oil prices hit a nine-month high as turmoil in the Middle East unsettled investors. Industrial sector fell 1.1 percent and ranked as the biggest decliner. Meanwhile, how did the international markets perform?

The European equity markets traded mostly to the downside, giving back some of yesterday’s solid advance that came courtesy of some upbeat Eurozone manufacturing data. However, the stronger-than-expected U.S. data helped stocks come off of the worst levels of the day. Stocks in Asia finished mixed as traders cheered yesterday’s stronger-than-expected manufacturing reports out of the U.S. and Eurozone, which complemented a favorable read on 2Q Japanese business sentiment.

U.S. markets are closing early tomorrow and all of Thursday for Independence Day. Expect strong activity as traders are adjusting their positions before the all-important non-farm payrolls report on Friday.

Our Trend Tracking Indexes (TTIs) changed only slightly with the Domestic TTI slipping to +1.30% while the International TTI ended at +3.61%.

Contact Ulli

Comments 2

Regarding stop loss orders. If you are using a 3% stop loss do you use a trailing stop order or wait until the ETF closes 3% below a previous high and then enter a market order to sell at the next opening? Thanks for you advice.

Robert,

I track sell stops on a closing price only basis. So, if my sell stop was triggered last night, I then would place a limit order to sell today, unless there is a huge market rebound in the making in which case I would hold off another day in order to avoid a potential whipsaw signal.

Ulli…