The ETF/No Load Fund Tracker Monthly Review—March 31, 2013

S&P 500 Finishes At A Record High And Erases Losses From 2008; Europe Higher For A 10th Month

US equities finished March on a high, lifted by relief that Cyprus averted an economic collapse and surprisingly strong domestic economic data. On the last trading day of the month, the S&P 500 surpassed its record high closing set in October 2007, thus erasing all of its losses from the 2008 financial crisis. The Dow Industrials exceeded its 2007 all-time high on March 5.

The month’s economic data largely beat forecasts, providing more evidence the US economic recovery is allegedly gaining momentum. Revised Commerce Department figures showed gross domestic product expanded by 0.4 percent in the final quarter of 2012, better than a 0.1 percent previous estimate.

Construction spending rose by 1.2 percent in February, beating the 1 percent rise predicted by economists. Home prices in January jumped the most since 2006. Also consumer confidence surged unexpectedly in March while consumer spending in February climbed the most in five months.

On a downbeat note, the Institute for Supply Management’s factory index slipped to 51.3 in March from 54.2 percent in February. A separate survey by Markit showed US manufacturing slowed slightly in March, with its reading coming in at 54.6, lower than the 55 level analysts had expected.

However, factory orders rose by 3 percent in February, driven mainly by higher orders for aircraft, a Commerce Department report revealed. Excluding transportation, orders rose a measly 0.3 percent. Orders for US-made durable goods, products expected to last at least three years, jumped 5.6 percent in February. Factory orders for January were revised upwards to show a 1 percent decline instead of the 2 percent as originally reported.

European stocks marked their 10th straight month of gains in March, with the pan-European Stoxx Europe 600 index adding 1.3 percent for the month. Economic turmoil in Cyprus hogged headlines for the better part of the month while continued political stalemate in Italy brought the country back in the limelight.

Corporate earnings-growth is likely to limit the impact of tighter fiscal policies in the US. With more data showing the US economy getting stronger, don’t be surprised if the Fed slows down the pace of its monthly bond purchases in the second half of 2013, unless Europe springs unpleasant surprises.

Of course, once the Fed slows down its money printing efforts from the current $85 billion per month, there is no way of knowing if the market indexes can continue their torrid pace; but I doubt it.

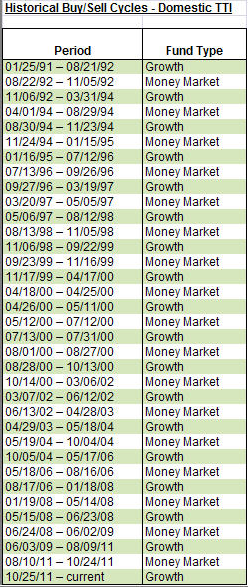

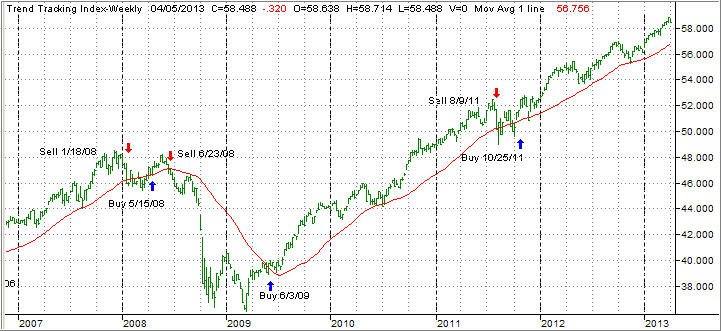

Our Domestic Trend Tracking Index (green line) headed north following the direction of equities and ended the month solidly on the bullish side of the trend line (red line) as the chart shows:

With all that bullishness, thanks to the Fed’s injection of newly created money, it came as no surprise that bonds floundered and some of them even broke their trend lines to the downside. As a result, I liquidated BND and TIP.

The place to be invested in given the assist the Fed has been throwing is equity ETFs. My preference has been, as I posted frequently, to seek exposure in low volatility products. Again, do not confuse low volatility with low performance as the ones we are invested in have all outperformed the S&P 500 YTD.

Some of my favorites are consumer staples (XLP) followed by the low volatility S&P 500 index (SPLV) both of which helped recent portfolio performance. Once the market turns south again, I would expect these ETFs to lag the overall market keeping us exposed a little longer and therefore avoiding a whipsaw signal in the event a pullback is only short-lived.

If a market top is reached, which will happen at some time, our trailing sell stops are in place to pull us out before serious damage occurs. With the markets being as manipulated as they are and Europe pretty much stuck in a severe economic slowdown, a sudden unexpected event could bring the equity indexes more in line with real underlying fundamentals, which is simply a nice way of saying that a sudden and violent correction could be one of those unintended consequences of central market planning.

That’s why I keep harping on the fact that a disciplined exit strategy is an absolute “must have” in order to deal with the uncertainties of our times.

Contact Ulli