US indexes continued their upward momentum with the Dow Industrials closing at a new record high as the number of Americans who filed for unemployment benefits fell to a six-week low, showing further improvement in the labor market.

Ahead of Thursday’s open, the Labor Department said initial applications for unemployment benefits fell unexpectedly to 340,000 last week. That was down from an upwardly revised tally of 347,000 the prior week. The six-week average dropped to its lowest level since March 2008.

Another Labor Department report showed productivity of American workers dropped 1.9 percent in the fourth quarter as companies hired more and increased hours.

Separately, the trade deficit in the US widened more than forecast in January on increased demand for imported crude. The gap grew $44.4 billion from $38.1 billion in December, Commerce Department figures showed in Washington.

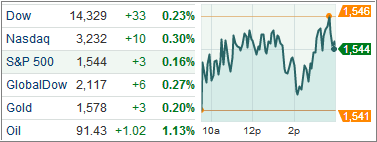

The Dow Jones Industrial Average (DJIA) added 33 points with the blue-chip index extending gains into a fifth session while the S&P 500 Index (SPX) picked up 3 points with financials leading the gains and utilities sliding the most among its 10 major business groups.

Treasury prices fell for a fourth day, the longest losing streak since January and pushing yields on 10-year notes to the highest level in nearly four weeks as an unexpected decline in weekly jobless claims spurred demand for riskier assets.

The euro advanced against the US dollar Thursday after remarks from the European Central Bank president suggested an interest rate cut isn’t coming in the near term.

The British pound, meanwhile, reclaimed the $1.50 level after the Bank of England left its monetary policy unchanged.

Across the Atlantic, most European equity indexes advanced though the continent’s benchmark stock index nudged lower after the European Central Bank and the Bank of England kept their monetary policies unchanged.

National benchmark indexes rose in 13 of the 18 Western European markets while the pan-European Stoxx Europe 600 index finished 0.1 percent lower.

The ECB kept its benchmark interest rate unchanged at a record low of 0.75 percent today and predicted the euro-area economy will shrink 0.5 percent this year, more than the 0.3 contraction it had forecast three months ago. ECB boss Mario Draghi said monetary policy will remain accommodative as inflation expectations remain “firmly anchored.”

Investors also shifted their focus on Spain, where the government successfully auctioned the maximum targeted EUR 5 billion in public debt at a lower borrowing cost than the previous auction.

Trend wise, it was a mixed picture as the Domestic TTI pulled back slightly to +3.43% while the International TTI gained and closed at +10.34%.

For detailed momentum numbers and charts, please review the latest StatSheet, which I will post shortly.

Contact Ulli