US stocks turned sharply lower Wednesday, falling from five-year highs after minutes from the Federal Reserve’s last meeting showed the central bank may scale back its bond buying program. In other words, the odds have increased that the spiked punch bowl will be watered down.

The Fed’s Open Market Committee had said the central bank would continue buying bonds while holding interest rates at near zero until the job market improves substantially. But minutes from the Jan 29-30 meeting today showed some policymakers were in favor of slowing the purchases sooner than previously thought.

Figures from the Commerce Department on housing came in mixed. The number of new homes breaking ground in January fell 8.5 percent from the month before, although starts for single-family homes ticked up 0.8 percent to an annual rate of 613,000.

The government also reported building permits, a gauge of future demand, climbed 1.8 percent in January to an annual rate of 925,000 – the highest since June 2008. A separate report from the Labor Department showed the Producer Price Index rose 0.2 percent in January after declining 0.3 percent the month before. More expensive vegetables pushed up wholesale prices higher for the month.

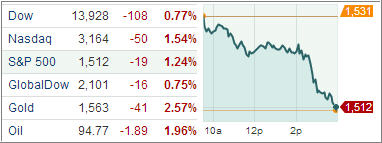

The Dow Jones Industrial Average (DJIA) tumbled 108 points with Caterpillar sliding 2.5 percent after saying global retail heavy-equipment sales fell in the first quarter. The S&P 500 Index (SPX) shed 19 points with basic materials sliding the most among its 10 business groups.

Treasury prices fell Wednesday, pushing the benchmark 10-year yields to the highest level in 10 months after the latest FOMC minutes showed policymakers continued to debate when to exit the stimulus program.

The US dollar meanwhile continued to strengthen against its rivals Wednesday after the US Fed’s policy minutes suggested the central bank may wind down its accommodative policies sooner than markets had anticipated. The US dollar rose to a 13-month high against the British pound after support for further quantitative easing got louder at the Bank of England.

European equities pulled back from a three-week high Wednesday as commodity producers retreated and eurozone consumer-confidence fell short of expectations, weakening risk appetite.

The Stoxx Europe 600 index dropped 0.3 percent to 289.07 after surging 1.1 percent yesterday. Analysts attributed the market jitters partly to Italian elections, due later this week, saying a market-unfriendly outcome will be bad for the euro and Italian bonds.

Investors also took note of eurozone consumer-confidence data for February, which rose to minus 23.6 from minus 23.9, but missed analysts’ forecast of minus 23 reading.

Germany’s DAX 30 index shaved 0.3 percent in Frankfurt, weighed down by Lufthansa AG. The German flagship carrier tumbled 6.2 percent after Europe’s biggest airline by sales cancelled dividends for 2012 to preserve cash.

The CAC 40 index lost 0.7 percent in Paris after index-component France Telecom slipped 2.1 percent. The French telecom major reported a 79 percent decline in 2012 profits and said it expects a difficult year in 2013.

With equities hitting the skids, our Trend Tracking Indexes (TTIs) followed suit and moved closer to their respective trend lines with the Domestic TTI now hovering at +2.80% while the International TTI closed at +10.33%.

As the chart above shows, the usual afternoon “lift-a-thon” was conspicuously absent as selling accelerated into the close. This leaves us with the question as to whether this was just a one day aberration or the beginning of more downside action. We will find out soon if the Fed is ready to lend an assist again by propping the indexes back up to their previous levels.

Contact Ulli