US equities finished lower for a second straight day as a weak regional manufacturing report weighed on investor sentiment while concern mounted that the US Federal Reserve will scale back the pace of stimulus.

The Federal Reserve Bank of Philadelphia’s index fell to minus 12.5 in February, the lowest since June, from minus 5.8 the month before. Readings below zero indicate contraction. The new-orders index fell to negative 7.8 from negative 4.3 in January as weakening new orders hit manufacturing in the area covering Delaware, southern New Jersey and Pennsylvania.

Sales of existing home sales rose 0.4 percent in January, the National Association of Realtors reported. However, the number of homes for sale fell to the lowest level in more than 13 years, indicating a shrinking inventory, the Washington-based trade group said.

Initial jobless claims rose by 20,000 to 362,000 in the week ended Feb 16, a Labor Department report revealed.

The Consumer Price Index remained allegedly unchanged month-over-month in January, but was up 1.6 percent from a year ago. Core CPI, which leaves out more volatile components like food and energy, increased by 0.3 percent month-over-month in January.

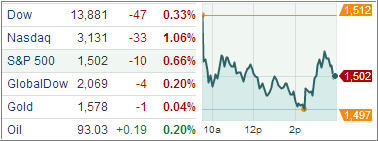

After sinking as much as 93 points, the Dow Jones Industrial Average (DJIA) closed 47 points lower. Breadth within the blue-chip index continued to trade negative with 20 of the 30 components finishing in the red.

The S&P 500 Index (SPX) shed 10 points with all the 10 business groups in the benchmark index finishing lower. Basic-material shares posted the biggest drop as investors sold shares of companies most tied to economic growth while consumer staples held up very well.

Treasury prices rose, pushing the benchmark 10-year yields below 2-percent, on a day when weak economic data combined with concerns over whether Washington will be able to avert automatic spending cuts in March.

The US dollar extended gains against major rivals Thursday while the euro sank to a six-week low after manufacturing data in either side of the Atlantic came in weaker than anticipated.

Meanwhile, European stocks showed steep losses Thursday, declining the most in more than two weeks as a gauge of services and manufacturing output contracted a day after the minutes from the US Federal Reserve’s policy meeting showed differences over the central bank’s monetary-easing policy.

The Stoxx Europe 600 index gave back 1.5 percent with banks and mining firms leading the decline. All the 19 industry groups in the index fell with a gauge of carmakers retreating 2.5 percent.

The DAX 30 index tumbled 1.9 percent in Frankfurt with Deutsche Bank AG and Commerzbank AG giving up 3.6 percent and 3.5 percent, respectively.

The CAC 40 index got hammered 3.4 percent in Paris, weighed down by Societe Generale and PSA Peugeot Citroen. The bank shed 4.5 percent while the carmaker erased 4.2 percent.

UK’s FTSE 100 index fell 1.6 percent in London, dragged lower by banks and miners. HSBC Holdings PLC dropped 2.3 percent.

In other words, the sell off was global in nature and our Trend Tracking Indexes (TTIs) followed suit but remain on the bullish side of the trend line by +2.54% (Domestic TTI) and +9.06% (International TTI).

For complete charts and momentum numbers please see the latest StatSheet, which I will post shortly.

Contact Ulli