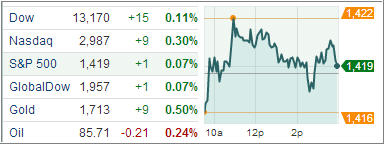

The major market indexes finished modestly higher with the S&P 500 index extending tiny gains into the fourth straight session, it’s longest since August after economic data in China beat estimates, overshadowing political uncertainties in Europe and the continued stalemate over budget negotiations in Washington.

Europe was back in the spotlight after Italian Prime Minister Mario Monti unexpectedly announced plans to step down after the parliament passes a national budget later this month.

In Asia, Chinese stocks rallied with the Shanghai Composite Index jumping to a four week high after retail sales and factory output data beat economists’ estimates while revised data indicated Japan has slipped into recession.

In the US, the President and the House Speaker John Boehner met one-on-one at the White House to discus how to avert the billions in spending cuts and tax hikes set to start next year.

Pushing yields back towards their lowest level in two weeks, Treasuries rose Monday, trading in their tightest range since 2010 before the Federal Reserve begins its two-day policy meeting tomorrow.

The Fed is expected to continue the purchase of longer-dated securities and announce the end of the other part of the program known as Operation Twist; selling of shorter-term debt when it ends its two-day meeting on Tuesday. There is however, little doubt about the Fed continuing its mortgage-securities purchases, a separate program come to be known as the third round of quantitative easing, QE3.

The US dollar eased Monday after the euro reversed initial losses following Italian Prime Minister Mario monti’s decision to step down after former premier Silvio Berlusconi led PDL party withdrew its support for the technocratic government.

Broader European stock markets tracked Wall Street higher even as Italian bank shares retreated sharply on Monday after the country’s technocratic Prime Minister Mario Monti said he’s prepared to resign after the Parliament approves budget later this month.

Political uncertainty in Italy spurred a sell out in Spain with the IBEX 35 index tumbling 0.6 percent and yield on 10-year notes jumping nine basis points to 5.54 percent.

The Athens General Index however bucked the trend among the peripheral nations and rose by 1.4 percent after Greece extended the deadline for its bond buyback program to Tuesday 12:00, London time.

With the Fiscal Cliff talks continuing without much progress and the US debt ceiling debacle being the next issue to be addressed, here’s a video that visualizes the US debt using physical $100 bills.

Presented without comment:

Contact Ulli