US equities fell today as the public standoff between the Republicans and Democrats in reaching a deal to avert recession-inducing tax hikes and spending cuts in the New Year overshadowed a drop in jobless rates and growth in retail sales.

Ohio Republican John Boehner criticized the Democrats for looking to punish small businesses through tax hikes while addressing a news conference on what is stalling negotiations to avoid the so-called fiscal cliff and blasted President Obama for not being “serious” about spending cuts.

Nevada Democrat and Senate Majority Leader Harry Reid retorted that Americans should not be held hostage to Boehner and his press events in a separate news conference. White House spokesman Jim Carney also entered the fray stating Republican opposition to higher taxes on the wealthiest two percent is holding up a deal. And so it goes tit-for-tat…

Equities had rallied earlier after initial jobless claims fell by 29,000 to 343,000 last week, adding the evidence the Labor market is improving. As demand for holiday shopping and automobiles picked up, US retail sales surged 0.3 percent in November. Producer prices also eased 0.8 percent last month.

The Federal Reserve, along with the European Central Bank, the Bank of England, the Bank of Canada and the Swiss national Bank, extended an existing temporary US dollar liquidity swap arrangement that makes it cheaper for banks to borrow in US dollars, for another year. The policy was set to expire in February 2013 previously.

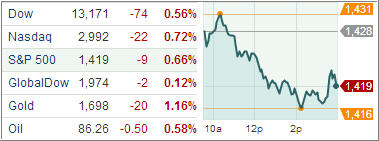

After rising as much as 0.2 percent in early trade, the Dow Jones Industrial Average (DJIA) dropped 75 points, with the healthcare sector pacing the slide.

Halting a six-session winning run, its longest since August 10, the S&P 500 Index (SPX) fell 9 points with energy and healthcare fronting the losses that included all the business groups.

Treasury prices, which move inversely to yields, declined for the third day as a drop in initial unemployment benefits claim and gain in retail sales diminished the allure of safe haven assets.

The US dollar surged to a near 10-month high against the Japanese yen while holding its ground against the euro after the currency union’s leaders approved additional money for Greece and agreed to a single supervisor for the region’s banks, thus moving closer to a banking union.

In Europe, finance ministers agreed on a deal that gave the European Central Bank authority to supervise the region’s biggest banks. Greece was also in the focus after the country secured a much-delayed EUR 49.1 billion bailout package following the successful completion of its debt buyback program earlier this week.

Germany’s DAX 30 index shed 0.43 percent in Frankfurt, dragged down by Deutsche Bank. Germany’s biggest lender lost 3.75 percent after the bank said restructuring costs will have significant impact on fourth quarter results.

Our Trend Tracking Indexes (TTIs) slipped with the major indexes but remain on the bullish side of the trend line by +1.56% (Domestic TTI) and +6.14% (International TTI).

If the Fiscal Cliff fighting continues with no solutions, more downside moves are a sure thing, as the markets have a priced in a compromise between the warring parties.

Contact Ulli