The S&P 500 snapped a five-day winning streak in the first full trading session since Wednesday, with stocks finishing mostly lower Monday as investors grew wary ahead of budget negotiations in Washington and Europe struggled to reach a consensus over Greece that would release the next tranche of aid money.

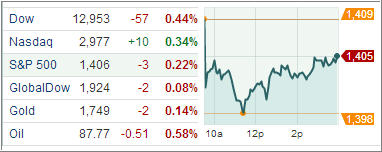

After slipping 109 points in early trade following comments by minority leader in the Senate Mitch McConnell on the impending budget stalemate, the Dow Jones Industrial Average (DJIA) trimmed losses to finish 57 points lower after White House Press Secretary Jay Carney issued a statement stating a deal on the fiscal cliff could allegedly be reached soon.

The mood on Wall Street soured further after pro-independence parties won a majority in Spain’s Catalonia region, strengthening the chorus for referendum on secession next year.

Breadth within the equity benchmark turned negative as the blue-chip index came off its best weekly performance since June with 23 of the 30 components finishing in the red.

Treasuries advanced, pushing yields lower for the first time in five days to pare last week’s losses as investors watched euro area finance ministers meeting in Brussels for the second time in less than a week to strike a deal that will put Greece on the path financial recovery.

The US dollar changed little as lawmakers met after the Thanksgiving break to avert the so-called “fiscal cliff” that will result in $600 billion in government spending cuts and automatic tax hikes.

European stock markets turned jittery as EZ finance ministers met for the third time this month to discuss Greece debt sustainability and potentially clear the decks for the nation’s next tranche of bailout money.

The Stoxx Europe 600 index slipped 0.5 percent to end at 272.00 after gaining the most in nearly a year last week.

The IBEX 35 index slipped 0.4 percent after secessionist parties scored a major victory in the Catalonia region in Sunday’s election. Banco Santander tanked 0.6 percent.

Banks were in retreat across Europe on Monday. The DAX 30 index fell 0.2 percent in Frankfurt, dragged down by a 1.9-percent decline in Deutsche Bank.

Royal Bank of Scotland Group Plc sank three percent while HSBC dropped 0.9 percent in London, dragging the FTSE 100 index lower 0.56 percent.

In the ETF space, the United States Natural Gas Fund (UNG) sank 3.52 percent after forecasts of a warmer-than-usual December that may temper demand.

The Market Vectors Egypt Index ETF (EGPT) crashed 7.17 percent after violent protests broke out across the country as President Mohammad Morsi gave himself sweeping powers. The fund has however, returned an impressive 48.94 percent year to date till November 23.

Our Trend Tracking Indexes (TTIs) change only slightly and have reached the following positions:

Domestic TTI: +1.56%

International TTI: +3.67%

The fiscal cliff negotiations will be the major event that will push the market indexes around over the next few weeks. I expect all kind of photo-ops and “near agreement” announcements along with subsequent denials resulting in increased market volatility.

Should, against all odds, an agreement be reached, which will be positive for the markets, a resumption of the upward trend is likely, and we will re-position ourselves accordingly. If negotiations fail, expect a major sell off in all equity indexes.

For quick access to the most recent StatSheet including TTI charts and all momentum figures, click here. You can read the latest ETF Model Portfolio update here.

Contact Ulli