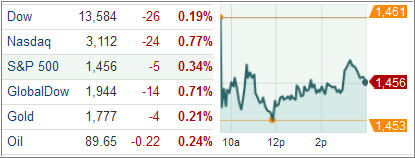

There was no surprise in this corner as Wall Street pulled back in anticipation of a weak earnings season with the 11-quarter year over year streak of gains being in jeopardy.

Even though expectations have been ‘dumbed’ down, it’s still questionable whether this very low bar can even be conquered. If not, we’re in for a pullback, which is long overdue anyway given the total disconnect from underlying fundamentals.

Analysts are looking for a correction in the area of of 3-5% no matter how earnings turn out. While I would not hold my breath, I have repeatedly said that the downside is bound to come into play despite the Fed’s attempts to the contrary. The unanswered question is what the trigger will be to give the bears the upper hand for a change.

As was expected, volume was meager during the Columbus Day session with bond markets remaining closed. Right now, all eyes are focused on Alcoa’s results due out after the market close tomorrow.

Spain remains front and center as the world awaits a signal to see whether the request for rescue funds is finally forthcoming. German chancellor Merkel is due to arrive in Greece tomorrow for some talk, for which she may not be very welcomed.

Just in case, Greece has activated some 6,000 police officers to offer hopefully adequate protection. Personally, I can’t see any reasons for her visit other than it’s one of goodwill to help her gain points for her own re-election campaign.

The population will most likely give her the type of welcome she may not forget for a long time.

There were no significant changes with our Trend Tracking Indexes (TTIs).

Contact Ulli