Equity Indexes pulled back today after surging to multi-year highs Friday as risk sentiment weakened amid news reports that Greece has initiated talks with creditors after its ruling-coalition failed to reach an agreement over spending cuts.

Markets are jittery ahead of Wednesday’s German high court’s decision on the validity of the EUR 500 billion European Stability Mechanism (ESM) even as speculation over the prospect of another round of assets purchase by the Fed rose (expected Thursday) following weak employment data.

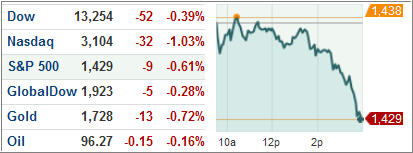

The Dow Jones Industrial Average (DJIA) lost 52 points while breadth within the blue-chip index turned negative with decliners eclipsing gainers 19-to-11. The S&P 500 Index (SPX) fell 9 points, or 0.6 percent, with telecommunications the sole gainer and tech hitting the ground hardest among its 10 business groups.

Treasuries advanced marginally in late trade following media reports that Spanish Prime Minister Mariano Rajoy is yet to decide on seeking help from the European Union. Yield on the benchmark 10-year Treasury notes slipped two basis points to 1.66 percent while 30-year Treasury bond yields shed one basis point to trade at 2.81 percent.

The USD gained traction Monday after slipping to a four-month low against a basket of six currencies Friday as investors turned to the global reserve currency ahead of Wednesday’s all-important German court ruling on the European Stability Mechanism.

The dollar index, a gauge of the greenback’s strength against a basket of six currencies, rose to 80.408 from 80.182 in late North American trade Friday, the lowest since early May.

Meanwhile, European stocks finished lower with the Stoxx Europe 600 index shedding 0.2 percent as investors moved to the sidelines as the week of big event risks rolled in. The German court is due to give its ruling on the region’s permanent bailout fund, the European Stability Mechanism, while the Netherlands goes to polls on the same day and European finance ministers meet Saturday to discuss Spanish and Greek bailout conditions.

Moving in the opposite direction, Greece’s Athens General Index jumped 4.7 percent after a report in Der Spiegel magazine over the weekend suggested Chancellor Angela Merkel may consider more flexibility for the stricken country to ensure it stays in the currency union.

Elsewhere, the French CAC 40 index slipped 0.4 percent while Germany’s DAX 30 index finished 0.1 percent lower.

In the ETF space, the Barclays iPath S&P 500 VIX Short-Term Futures ETN (VIXY) vaulted 5.53 percent after so-called fear-tracking volatility index (VIX) jumped 13.21 percent as risk appetite diminished ahead of an eventful week.

Other VIX-linked funds like the ProShares VIX Short-Term Futures ETF also surged, adding 5.54 percent on the day. The United States Natural Gas Fund LP (UNG) surged 5.08 percent after reports from the EIA suggested Hurricane Isaac forced shut-in natural gas production of 3.2 billion cubic feet per day in the Federal Offshore Gulf of Mexico.

It’ll be a week of high anxiety as any of the scheduled events have the power to derail the markets should expected outcomes disappoint. I believe that any negatives have not been priced in the current level of the major indexes.

Disclosure: No holdings

Contact Ulli