- Moving the market

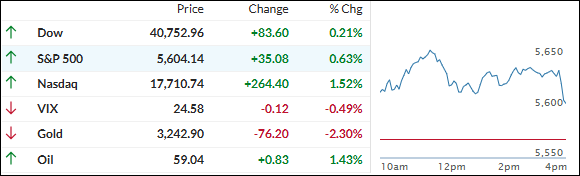

Equities started the day on a downward trend as traders eagerly awaited the Fed’s policy decision tomorrow.

They were also tracking global news for any signs of progress on potential trade deals. Tech giants Nvidia and Meta, along with Tesla, saw declines. Tesla’s new car sales in Britain and Germany fell to their lowest levels in over two years, despite increasing demand for electric vehicles.

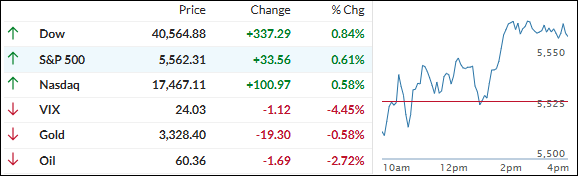

The Fed began its two-day meeting today, with a decision expected tomorrow. Anxiety remains high on Wall Street, even though a rate cut is not anticipated. The focus will be on Powell’s comments regarding the current state of the economy and his outlook.

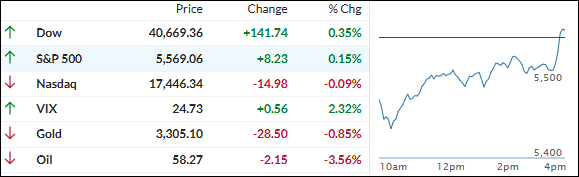

The S&P 500, along with the broader market, faces a significant challenge at its 200-day moving average (200DMA), which has been providing strong overhead resistance. If the attempt to break through this level is unsuccessful, we may see a reversal towards the lows made in April.

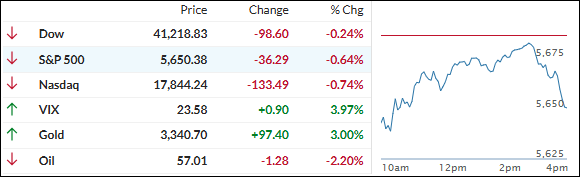

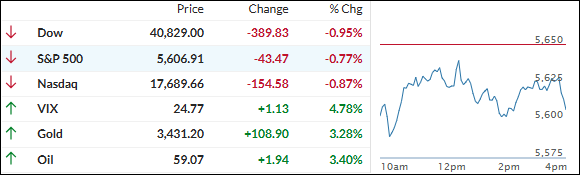

With low trading volume across the board, all attempts to rally above the unchanged lines failed, and the major indexes ended the session in the red.

Bond yields slipped, the dollar continued its decline, and Bitcoin recovered from an early drop to climb back above $95,000. Gold had another impressive performance, gaining over 3% and reclaiming its $3,400 level.

The markets are at a crossroads and could break either way. As ZH pointed out, price action is mainly driven by short-term headlines and speculation on the evolving US tariffs story.

Read More