- Moving the market

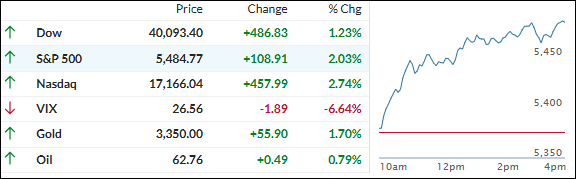

The tech sector led the ongoing rebound, as traders sought signs of progress in the heated tariff situation.

Despite China’s overnight announcement that no trade talks were happening with the U.S., they confirmed that all statements about progress on bilateral talks should be dismissed and that the cancellation of unilateral tariffs is forthcoming.

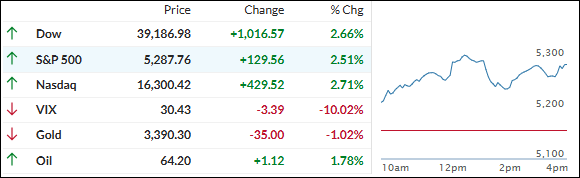

Wall Street traders found Trump’s less confrontational approach toward talks with Beijing more convincing, which fueled bullish sentiment for the third consecutive day.

While the markets are hoping for a reversal of tariffs or significant trade deals, we are still in correction territory. It remains to be seen whether the current optimism will push both indexes back onto a bullish path.

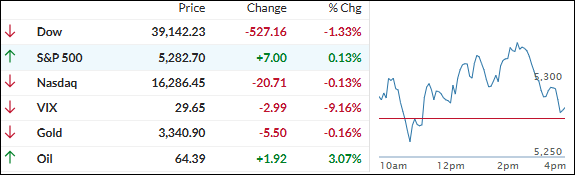

Recent economic “hard” data has crushed the “recession is imminent” narrative, although “soft” data remains weak, as illustrated by this chart.

Despite the headline fluctuations, the markets advanced steadily without any significant intraday selloff.

Bond yields dropped, the dollar retreated from yesterday’s highs, which helped gold rebound from its recent pullback, while Bitcoin maintained its gains.

Can the markets close out this week with another win tomorrow?

Read More