Robust US economic data on factory output and housing failed to halt the broad slide as US stocks closed lower Wednesday for the fourth straight trading session. Though the day had started off strongly, but concerns over Greece weighed on investor sentiments and down we went.

Yield on the benchmark 10-year Treasuries sank to a seven-month low after the US Federal Reserve said further intervention can’t be ruled out to maintain the growth momentum while the European Central Bank announced it would suspend some operations with Greek banks.

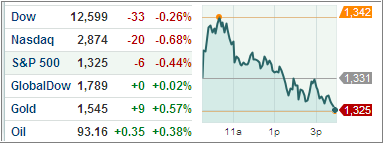

After surging 90 points earlier, the Dow Jones Industrial Average (DJIA) shed 33.45 points to settle at 12,598.33, the lowest level since Jan 18.

The S&P 500 Index (SPX) lost 5.86 points to end at 1324.80 with consumer-staples faring the best and financials dropping the hardest among its 10 business groups.

The NASDAQ Composite Index (COMP) tumbled 19.72 points to close at 2874.04.

Optimism over the US recovery pushed Treasuries lower as demand for safe assets diminished earlier. Demand however, picked up after minutes from the April FOMC meeting showed that several Fed officials advised further stimulus measures to maintain the current growth momentum.

Yield on the benchmark 10-year notes slipped one basis point to close at 1.76 percent. 10-year Treasury yield had earlier climbed to 1.82 percent after reports showed builders broke ground for more homes in April and industrial production grew faster than estimated.

ETFs in the news:

Among the day’s winners, the United States Natural Gas Fund (UNG) came out tops, jumping 5.14 percent for the day.

Other natural gas futures related products like the Teucrium Natural Gas Fund (NAG) and the United States 12 Month Natural Gas Fund (UNL) also remained among the top gainers, rising 3.47 percent and 2.60 percent, respectively.

Among the day’s top losers, the Invesco PowerShares Global Steel Portfolio (PSTL) remained on top, shedding 6.80 percent as commodities continue to retreat amid Greece exit concerns.

The other prominent steel related product, the Van Eck Market Vectors Steel Index ETF (SLX) also felt the heat, losing 2.06 percent for the day.

The Global X Uranium ETF (URA) also featured prominently among the laggards, dropping 4.68 percent for the day as materials got hammered across the board today.

In regards to long-term trends, our International TTI has slipped further into bear market territory (-3.07%) supporting our recent Sell signal for that area. Domestically, we still remain on the bullish side by +2.51%. Remember that the TTIs are lagging indicators, so be sure to have your trailing sell stops guide you as to when to exit.

By the time the actual crossing of the domestic trend line into bear market territory occurs, you should no longer own any domestic equity positions.

Disclosure: No holdings

Contact Ulli