Following the government’s nonfarm payrolls report on Friday that showed companies added fewer jobs than forecast, US stocks suffered their biggest loss in over a month on Monday, reacting on the first trading day since the report was published last week.

Analysts however, attributed Monday’s pull-back to profit booking by investors, pointing out average monthly job-addition still tops the 200,000 mark.

As demand for US safe-haven assets shot up amid fears of a global slowdown, US 10-year Treasuries made their biggest gain in four weeks Monday. Yields on Treasuries dropped following speculations of further rounds of quantitative easing by the Federal Reserve in view of the lousy job market data.

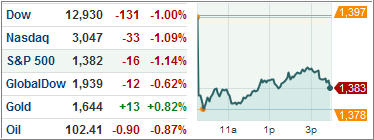

The Dow Jones Industrial Average (DJIA) fell 1 percent and the S&P 500 Index (SPX) shed 15.88 points to close at 1382.20, with financials and industrials declining the most. All the 10 sectors in the index closed lower.

The NASDAQ Composite (COMP) dropped 1.1 percent to close at 3047.08.

Decliners outpaced advancers by nearly four-to-one on the NYSE.

ETFs in the news:

Uncertainties over last week’s job data pushed the iPath S&P 500 VIX Short Term Futures ETN (VXX) up 6.3 percent on Monday. The fear-tracking fund is now up for the fifth successive day, scaling new April highs.

Fixed income funds are in strong demand as US indices get battered. The iShares Barclays 20+ Year Treasury Bond Fund (TLT) surged 2.3 percent on the day, getting past its 50-day moving average for the first time since Feb.

The yellow metal is back in action after market expectations of further assets purchase by the Fed were dashed. As markets headed lower, the iShares Gold Trust (IAU) added 0.69 percent on the day.

Among the day’s top losers, the premium-laden iPath Dow Jones UBS Natural Gas Subindex Total Return ETN (GAZ) shed a whopping 9.52 percent for the day. Despite losing value in the recent past, the ETF’s premium continues to be around 90 percent.

The SPDR S&P Biotech ETF (XBI) slipped 2.84 percent as the broad market indices tumbled. The situation was exacerbated due to lack of economic news as a slew of top holdings retreated ahead of the unofficial beginning of the earnings season on Tuesday.

The alternative energy sector remained under pressure as investors pulled out of “riskier” stocks on Monday. The PowerShares WilderHill Clean Energy Portfolio (PBW) shed 2.29 percent as China growth worries and return of the sovereign debt crisis in Europe lowered the market’s risk appetite.

In regards to trends, nothing really changed as both of our Trend Tracking Indexes (TTIs) remain in bullish territory, although the International TTI has shown more weakness than its domestic cousin.

Disclosure: Holdings in TLT

Contact Ulli

Comments 2

If my mutual fund corrects 7% from its closing high, when do I reinvest my money?

Paul,

I usually move the proceeds into money market first and re-enter at a later time once it becomes clear that current downward momentum has reversed again. Alternatively, you could reinvest in an area where the upward trend still remains intact.

Ulli…