Weak economic news proved to be a drag on equity ETFs as Europe’s main engine, Germany, just about stalled in regards to second quarter GDP. Domestically, housing starts in July were nothing to brag about.

German and French leaders proposed to better coordinate financial planning and to enact a tax on financial transactions. Lovely; I wonder if there ever will be a solution forthcoming that involves cutting waste and not raising taxes. Go figure…

In any event, our Trend Tracking Indexes (TTIs) ended up in the following positions:

Domestic TTI: +1.27%

International TTI: -8.40%

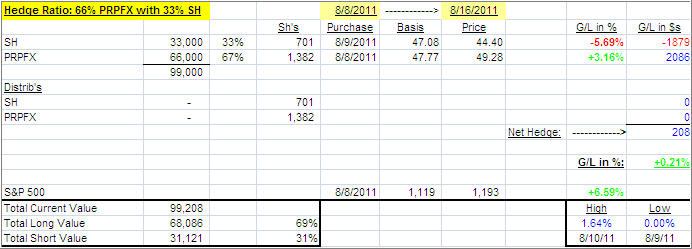

There are no changes to our holdings. Our PRPFX hedge inched a little more into positive territory as the matrix shows:

If you scan the news items on your favorite financial site, you will notice that stories about global economic slowdowns are rapidly increasing. That eventually will affect the equity markets, which still seem to be in denial about the magnitude, or lack thereof, of the current recovery.

More of a domestic slowdown, or even a recession, is a sure thing in my opinion. The question is as to when it will matter and affect market direction. It pays to maintain a cautious stance as downside risk far outweighs upside potential at this particular time.

Contact Ulli