Another breathtaking day in the market, this time on the bullish side, pushed the S&P 500 exactly back to Tuesday’s level.

A modest rebound, fueled by better jobless claims and no bad news out of Europe, turned into a monster rally as short covering proved to be the catalyst to wipe out Wednesday’s losses.

Of course, as we have seen recently, short covering rallies don’t have much duration, which means I don’t read much into one day market bounces, since they tend to be head fakes more often than not.

This is the time to be either out of this market insanity or in a hedged position. Outright long or short positions can easily result in big losses.

As was to be expected, with that strong of a rebound, our Domestic Trend Tracking Index (TTI) rose and settled slightly on the plus side.

Here are today’s TTI closing numbers:

Domestic TTI: +0.19%

International TTI: -10.17%

Here we go again with the Domestic TTI doing the trend line dance. I will not turn bullish until the trend line has been clearly broken to the upside, and that position has held for a number of trading days.

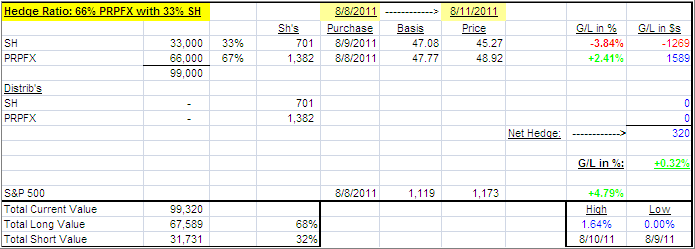

Our PRPFX hedge gave back some of its gains, but remains on the plus side of the equation. Here’s the updated matrix for today:

There is not much to say about this type of market behavior other than that it can be extremely dangerous to your financial health. Any bad news out of Europe will turn this rebound into a death trap.

On a day like this, a wise saying about investing comes to mind: “It’s better to be out, wishing you were in, than being in wishing you were out.”

True words indeed.

Contact Ulli

Comments 6

Ulli:

Thank you for all you do. It would be a great contribution if you would address some comparative strategies old times might embrace as it relates to either converting IRA’s to Roth IRA, on ways to avoid mandatory distributions?

Thank you.

Good morning Ulli, Quick question: Usually in your hedging discipline, you suggest rebalancing when the hedge gets our of balance, I am thinking you suggest 10% out of balance, bring the hedge back to established parameters (percentages). With this 67-33 split do you have percentage numbers in mind for rebalancing or am I missing something and rebalancing won’t be necessary. Thanx in advance, Mo

I bought the PRPFX equivalent….should I reduce FXF or just follow the 8% rule?

Joe,

That is a tax issue, and you need to take that up with your accountant.

Ulli…

Anon,

I will address that in a separate post, or weave it into my commentary later on, since the question has been asked by several readers.

Ulli…

Mike,

As I said in the original post, you use the entire portfolio to calculate your sell stops. Treat it as one fund just as you would PRPFX.

Ulli…