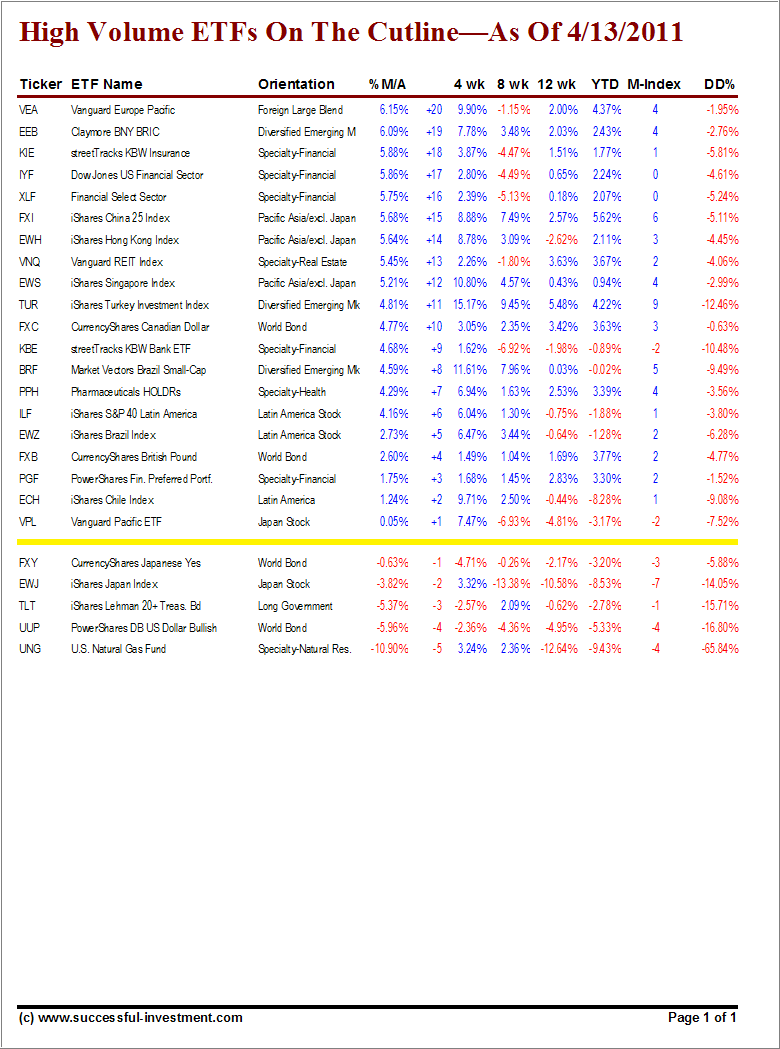

Here’s a slightly different version of the original “ETFs On The Cutline” report. It includes only High Volume (HV) ETFs, which I define as those with an average daily volume of $10 million or higher.

These ETFs are generated from my selected list of 90 that I use in my advisor practice. It cuts out the “noise,” which simply means it eliminates those ETFs that I would never buy because of their volume limitations.

Short ETFs are not yet included but will be in the future. Take a look at the table:

Again, we’re 2 years into this bull market, so there are not many ETFs below the line. The bottom of the barrel remains the Natural Gas fund (UNG), which has been on a losing streak for years. That’s one ETF that has given new meaning to the famous last words “buy it on a dip—it can’t go any lower.” Yeah right.

If you are a new reader and missed the original Cutline report, which also featured some “how to use” information, please review it here.

Contact Ulli

Comments 2

Dear Ulli,

Thank you for this post.

Would it be possible for you to post the list of the 90 etfs that you regularly use for your clients?

10 mils $ a day seems low with etfs averaging 30 to 50$, that’s only a unit volume of 200000/day .Is that enough to insure a small bid/ask spread and in those days of “Flash crash”,how did those etfs fare during that event.

By the way,your logic and system realy suits me and I would consider having you managing my account but,as an European,it does not look practical.

Keep up the good work!

Thanks again.

Alain

Alain,

The $10 million volume is a minimum. Most are much higher, but I have found this to be a good threshold. The “Flash Crash” was simply intra-day market noise and did not affect us. My sell stops are based on closing prices only and not on what happens during the trading day.

Ulli…