Several readers have emailed wanting to know if there are more ETFs scheduled to come on the market that better cover the India region.

Good news here, as reported in “Emerging Global Plans Sector-Specific India ETFs:”

Emerging Global Advisors, the only ETF issuer focusing exclusively on emerging markets, has filed details on a suite of products that would offer more targeted exposure to India’s stock market. In a recent SEC filing, the firm detailed plans for nine ETFs focusing on specific sectors of the Indian economy:

* EG Shares India Consumer ETF

* EG Shares India Financials ETF

* EG Shares India Health Care ETF

* EG Shares India Telecom ETF

* EG Shares India Industrials ETF

* EG Shares India Technology ETF

* EG Shares India Utilities ETF

* EG Shares India Basic Materials ETF

* EG Shares India Energy ETF

The filing didn’t specify the indexes that the proposed funds would seek to replicate, but did note that the management fee would be 0.89%.

In addition, Emerging Global outlined an India High Income Low Beta ETF that would focus on dividend-paying Indian stocks that exhibit a relatively low beta relative to the broad Indian stock markets. Also included in the filing were details on a similar fund that would focus more broadly on emerging markets stocks; the Emerging Markets High Income Low Beta ETF would include dividend-paying companies in the emerging world that exhibit low beta relative to a broad-based emerging markets index.

India ETF Options Multiplying

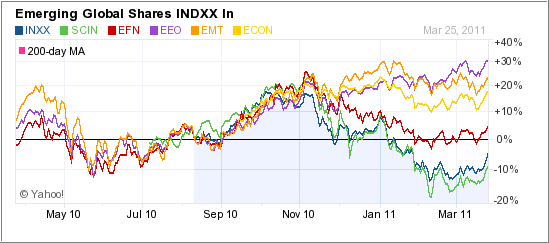

Emerging Global already offers two funds focusing exclusively on the Indian market, including the India Infrastructure ETF (INXX) and India Small Cap ETN (SCIN). INXX is the only sector-specific India ETF available to U.S. investors; all other products offer broad-based exposure to all corners of the market. Emerging Global’s product line already includes funds targeting specific sectors of broader emerging markets, including financials (EFN), energy (EEO), metals and mining (EMT), and consumer goods and services (ECON).

I have charted the India funds mentioned in the last paragraph and, as you can see, the recent trends are very mixed depending on the ETF. Not surprisingly, the 3 trending up are EEO, EMT and ECON, while the others are lagging behind.

If you decide to get involved in any of these markets, be sure to use my recommended trailing sell stop of 10%, which applies to all sector ETFs.

Chart courtesy of YahooFinance

Contact Ulli