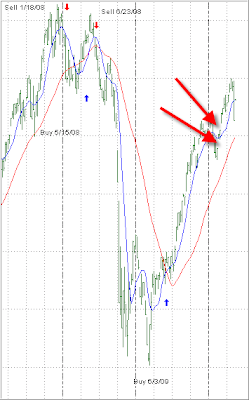

With last week’s market drop and Monday’s rebound still on everyone’s mind, let’s take a look at the big picture via the domestic Trend Tracking Index (TTI), which I have enlarged for better demonstration.

With last week’s market drop and Monday’s rebound still on everyone’s mind, let’s take a look at the big picture via the domestic Trend Tracking Index (TTI), which I have enlarged for better demonstration.

The two big red arrows indicate a gap opening as upside momentum picked up steam after the February pullback.

As I have mentioned in previous posts on this subject, gaps to the upside (called breakaway gaps) on a weekly chart are caused by this week’s high price being lower than next week’s lows price (more buyers than sellers) leaving a gap behind.

Gaps will always be closed meaning that prices eventually will retreat to “cover” them. The big unknown is the timing of it, which could be days, weeks or even years.

For example, take a look at the above chart and notice the large downside gaps (more sellers than buyers) during the meltdown of 2008. They were all closed a year later during the rebound of 2009.

As you can also see, the gap identified by the upper large red arrow was almost reached by last week’s market meltdown.

To me, these gaps are a good sign as to where equities will head sooner or later.

Further weakness could cover these gaps leaving us at an inflection point where the markets could break down further or resume their rally. Given how far we’ve come, the former may be more likely.

Violent market moves in both directions such as we’ve seen over past week are occurring most often during or at the beginning of bear markets. Mish at Global Trends featured some interesting charts on the subject yesterday in “Visualization About Violent Market Drops.” Towards the end he quoted this interesting fact:

The further increase in volatility is bearish. We often see that right at the beginning of major bear markets. You get some single day rallies that really impress everyone. We had one of those after the August 2007 swoon for instance.

Yet, the DJIA has never – not once – rallied 400 points during a bull market. Every single 400 point or more rise was in the context of major bear markets.

Those huge bear market rallies were all taken back and then some.

While we’re not in bear market territory according to my indicators, we did come close last week. Volatility has increased and it behooves you to be on guard and use your sell stops when necessary.

Yes, we may watch the market go higher and realize we’ve been whip-sawed with some of our positions.

Remember, that this is the investment insurance we pay every so often to guard against extreme downside moves. Should the market resume its upward trend, we will then look for a new entry point to re-deploy our idle cash.