Last week’s rally, and the fact that our domestic Trend Tracking Index (TTI) is now within striking distance of a Buy signal, caused a number of readers to email with comments and questions.

Last week’s rally, and the fact that our domestic Trend Tracking Index (TTI) is now within striking distance of a Buy signal, caused a number of readers to email with comments and questions.

Some old sayings such as “sell in May and go away” were quoted along with fears of whipsaws due to continued market volatility. Others were worried about economic fundamentals such as recession fears and large businesses like Citibank continuing to write-down massive amounts of losses.

What it came down to was the question “how can this market rally, when all other news is so gloomy?” Let’s look at some of the major concerns:

1. “Sell in May and go away.” Sure, that line is based on the fact that at sometime in the past this might have been a good decision, and I’m sure it will be again in the future. However, there have also been tremendous market rebounds, which lasted through the summer; so using that as basis for making investment decisions it simply not wise.

2. Yes, fundamentally, when you look at just about all economic data, a recession is said to have started a few months ago and, despite current market behavior, which is based on the fact that a bottom in financial assets has been reached, this up trend could very well reverse again.

Here’s were I differentiate between my view of the fundamentals and my investment methodology. My economic view currently supports a recession scenario, massive further write-downs, higher unemployment and a host of unknowns, all of them negative for the market.

However, that fundamental view and opinion has absolutely nothing to do with my investment decisions. I follow trends and when it’s time to move into the market, I will do so based on momentum figures. I simply accept the fact that I can have a different view of the world than my investment plan dictates, because with that plan I have removed the emotional and subjective factors.

Looking only at fundamentals creates such a huge number of variables which I can’t assess, so I simply remove most of them by strictly following price action via trends.

3. More write-downs are coming, that’s a pretty safe bet. The key is whether they come as a surprise to the market place (bad news) or are anticipated, because they turned out better than the worst scenario. For more on bean counter accounting in the case of Citibank’s $5 billion write down, see Mish Shedlock’s article “Digging into Citigroup’s numbers.”

4. Whip-saw fears. Last week I posted Whip-saw thoughts and offered some ideas as to how to handle them.

There is one absolute sure way for you to avoid any whip-saw signals: Don’t invest! Other than that you simply have to accept them as a part of doing business. The key is to keep the losses manageable. This is why I continue harping on the trailing stop loss.

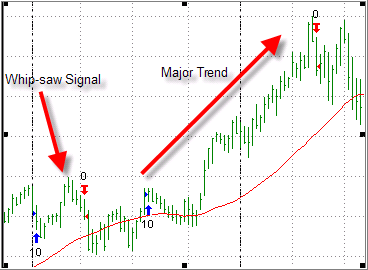

Getting whip-sawed and becoming afraid, could be hazardous to your financial health. Let’s take a look at the following chart:

As you can see, in this scenario, a whip-saw signal was followed by the resumption of the major trend, which more than made up for the small loss taken. While things will not always work out as in this example, it demonstrates the fact that you need to remove all emotional and subjective decisions as much as you can.

No, it’s not easy, but all successful long-term trend followers have learned this “secret” and so can you. Remove as many variables from your decision making process and focus only on what truly matters: Where is the trend headed?