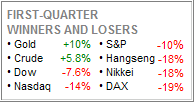

As it turned out, this past quarter was one that many investors, traders and advisors are glad to put behind them. The major markets, as the above table shows, were mired deep in red and many sector trends came to an end in January causing several whipsaws. It was the steepest decline in 5 years.

As it turned out, this past quarter was one that many investors, traders and advisors are glad to put behind them. The major markets, as the above table shows, were mired deep in red and many sector trends came to an end in January causing several whipsaws. It was the steepest decline in 5 years.

This is not to say that there weren’t any winners. According to my data base, the year-to-date honors go to the U.S. Natural Gas fund (UNG: +34.01%), followed by the iShares Silver Trust (SLV: +16.40%) and PowerShares Base Metals (DBB: +15.11%).

We did not have any positions in these top 3; I missed the beginning of the trend and extreme high volatility did not allow for a safe entry point later on. We stayed with our more conservative allocations in gold and Swiss Francs, but the small position size only had a limited positive effect on our portfolio.

Our Trend Tracking Indexes (TTIs) closed out the quarter being positioned relative to their long-term trend lines as follows:

Domestic TTI: -0.44%

International TTI: -6.76%

I can’t be sure, but I would expect a trend, either up or down, to be set in motion at some point during this coming quarter. History has shown that the longer a sideways pattern lasts, the stronger the subsequent breakout.

Contact Ulli