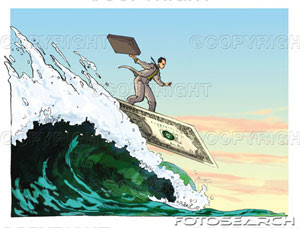

MarketWatch featured a story called “Tide’s Out – Fund Investors have wisely stopped performance surfing.” It goes into detail about the “dangerous” habit of always trying to own funds that always top the short-term performance charts.

MarketWatch featured a story called “Tide’s Out – Fund Investors have wisely stopped performance surfing.” It goes into detail about the “dangerous” habit of always trying to own funds that always top the short-term performance charts.

It’s media ignorance at its finest since the assumptions are flawed due to the fact that not every investor uses the brainless buy and hold philosophy. In my view, the most dangerous habit when investing is to be exposed to a fund/ETF that does ‘not’ perform. There is absolutely nothing wrong with being in top performers as long as you have an exit strategy in place via a trailing sell stop discipline.

After all, it’s only performance that propels your portfolio forward and not staying put in funds and ETFs that represent the bottom of the barrel, which includes about 80% of all offerings.

The story cites investors who loaded up on top tech funds only to get killed during the subsequent bear market. That has been my argument for some 20 years. Any investment you get into, whether it’s a high flier or an average performer, requires you to have a plan to get out. If you don’t, then this following formula will repeat itself over and over in your investment life when facing a bear market:

Buy and Hold = Investment Losses to the second power (humor attempt)

Doing the same thing over and over and expecting a different result each time is in some professions called insanity.

Comments 2

That was, indeed, a silly and patronizing article. The message is that all of us little boys and girls have grown up and learned how to buy and hold again. Well, if I did that I would have watched my REIT’s plummet this year. Instead I took fabulous profits and surfed into energy and Latin America, and will surf right out again when they hit my stops. Honestly, these writers are really daft. Thanks for pointing them out.

Jane,

Absolutely correct. In my advisor practice, we followed the same path of leaving losers and following winners.

Ulli…