- Moving the market

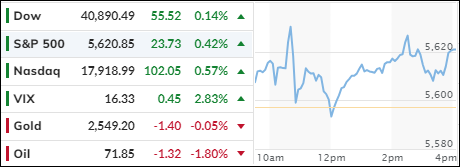

Equities drifted throughout the session following a strong week where the S&P 500 gained 1.5%. While the S&P 500 and Nasdaq ended in the red, the Dow managed to close at a record high.

Fed Chair Powell’s dovish stance on interest rates fueled traders’ enthusiasm, raising hopes that the long-awaited rate cut might finally materialize at the next meeting on September 18. However, the extent of such a move remains under discussion.

The sharp sell-off in early August, triggered by troubling employment data and the unwinding of the Japanese carry trade, not only dragged the major indexes from their highs but also caused the S&P 500 to suffer a 3% one-day loss, its largest since 2022.

This event has now been sidelined, as expectations of lower rates and supposedly improving economic data—pending revisions—have reignited bullish sentiment in equities. But how long will this optimism last?

Following Friday’s enthusiastic response to Powell’s announcement, rate-cut expectations eased today, with the MAG 7 stocks continuing their zig-zag pattern over the past three trading days.

The dollar recovered some of Friday’s losses, which would typically weaken gold, but the precious metal pushed towards its all-time highs.

Bond yields edged up slightly, while crude oil surged nearly 3%, reclaiming the $72 level. Bitcoin crossed the $65k mark over the weekend but failed to maintain those gains during today’s session.

With the Fed Chair’s comments behind us, all eyes now turn to Nvidia’s upcoming earnings report.

Will it have a similar market impact as Powell’s announcement?

Read More