- Moving the market

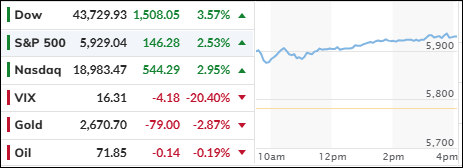

The major indexes began the session on a positive note, buoyed by anticipation of the Federal Reserve’s meeting on interest rates.

Despite the incomplete election results, traders seemed relieved, dispelling earlier concerns about a prolonged election process. However, any geopolitical news could still trigger significant and sudden swings in asset prices.

The much-anticipated Fed meeting concluded with Chair Powell announcing the expected 0.25% rate cut. Powell expressed confidence in the economy’s health, suggesting that the Central Bank would likely continue with small, incremental adjustments moving forward.

Wall Street views the second Trump administration as favorable for risk assets like stocks. However, it’s important to remember that persistent large deficits and higher tariffs could signal higher inflation ahead.

I think Powell’s decision to cut rates is questionable, especially since the Citi Economic Surprise Index has surged following the Fed’s aggressive 0.5% cut in September. Typically, rate cuts are implemented during economic downturns, not expansions. The bond markets seem to agree, as the 10-year yield has risen by approximately 0.7%, contrary to expectations.

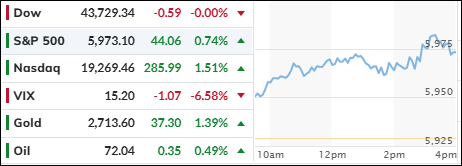

Today, bond yields retreated, with the 10-year yield dropping 10 basis points to close at 4.34%. The stock market ended mixed, with the S&P 500 and Nasdaq continuing their rally, while the Dow and Small Caps struggled to break out.

Mega-Cap Tech stocks moved higher, the dollar weakened, which allowed gold to rebound and reclaim its $2,700 level. Bitcoin remained unstoppable, extending its gains, and reaching a new record high.

The chart of the day illustrates that the much-discussed USA Sovereign Default risk has significantly diminished following the election results.

Read More