- Moving the market

This morning, the markets erupted with major benchmarks racing into record territory following Trump’s presidential election victory.

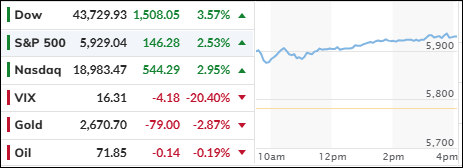

The Dow led the charge, jumping over 3.5%, while Small Caps surged nearly 6%. The S&P 500 and Nasdaq also set new record highs. Small Caps, which are primarily domestic and cyclical, are expected to benefit significantly from Trump’s proposed tax cuts.

Today’s gains were broad-based, with most investments poised to benefit from a Trump presidency. Tesla surged by 15%, and major banks like JP Morgan, Bank of America, and Wells Fargo saw increases of over 6%.

Bitcoin soared to a new all-time high of over $76,000, while the dollar climbed to its highest level in a year, driven by proposed tariffs that would strengthen the currency.

Bond yields surged, with the 10-year yield adding 15 basis points to reach 4.44%. This increase assumes that new tax cuts and other spending plans will spark economic growth, but also increase deficits and worsen inflation.

For now, sentiment has shifted to a pro-growth, pro-deregulation, and pro-market stance. Traders are also expecting a pickup in mergers and acquisitions (M&A) activity, which will further support a positive backdrop for equities.

Mega-cap tech stocks surged but did not reach record highs, while the most shorted stocks exploded upwards. However, gold struggled due to the dollar’s strength and rising bond yields, leading to a sell-off.

Traders are now anticipating a 0.25% rate cut tomorrow, with a 95% probability in their favor.

Does this mean that bond yields will continue to rise, thereby questioning the wisdom of the Fed’s policy?

Read More