- Moving the market

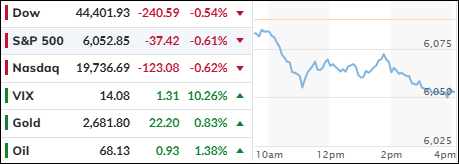

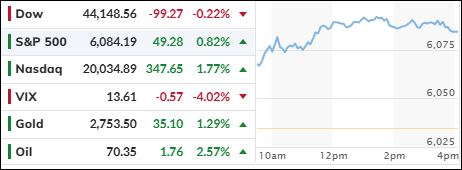

The latest inflation readings provided a boost to the markets, with the S&P 500 and Nasdaq achieving solid gains, while the Dow lagged. The Consumer Price Index (CPI) met expectations, showing a 0.3% rise from October and a 2.7% increase year-over-year. The Federal Reserve’s preferred measure, the core CPI, which excludes volatile food and energy prices, also rose by 0.3% for the month and 3.3% year-over-year.

Although this data indicated a faster pace than the previous month, traders speculated that it wasn’t high enough to prevent the Fed from cutting rates later this month, with the odds of a rate cut now at 99.9%.

Despite the anticipation of rate cuts, bond yields surged as prices dropped, while other assets like stocks, gold, the dollar, crude oil, and cryptocurrencies remained bullish.

The mega tech sector reached a new record high, gaining in 11 of the past 13 days. The dollar advanced for the fourth consecutive day, which typically would have negatively impacted gold, but the precious metal rallied by nearly 1.3% to close above $2,750.

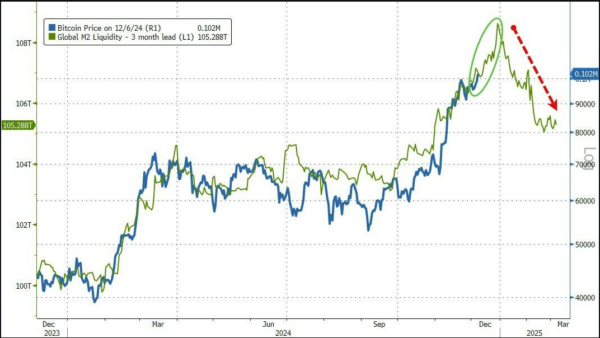

Bitcoin also spiked above $102,000, and crude oil reclaimed its $70 level, closing at a two-week high.

While traders have priced in a 0.25% rate cut for December, expectations for 2025 have significantly decreased, from six 0.25% cuts three months ago to just two for the entire year.

This makes me ponder: How will the markets respond to these changing expectations, especially since steadily rising rate cut expectations have been a key driver of the current equity bull market?

Read More