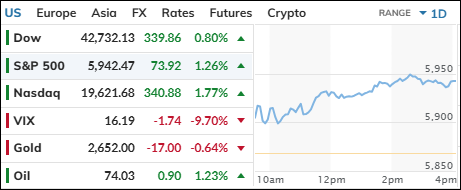

- Moving the market

This morning, the markets experienced a significant downturn, with the Nasdaq leading the decline. Bond yields spiked, with the 10-year yield rising by 6 basis points to 4.70%, its highest level since April 2024.

This spike was driven by the ISM Services Inflation Index, which surged to nearly two-year highs, casting doubt on the Federal Reserve’s willingness to further cut rates. Inflation expectations have now reached their highest point since February 2023, as noted by ZH.

The tech sector faced additional pressure, with Nvidia shares dropping nearly 6% and failing to recover from their worst losses of the day.

Additionally, Bank of America downgraded Tesla, causing its shares to slip by approximately 4.5%. This downgrade had a ripple effect, leading other mega-cap tech companies lower, along with Bitcoin, which fell below the $100,000 mark once again.

In contrast, gold managed to buck the trend, gaining 0.65% amid a moderate comeback rally in the dollar.

A press conference held by President-elect Trump generated a slew of headlines, ultimately pushing the volatility index higher and driving equities across the board lower. ZH compiled the following notable headlines:

-*Trump to announce $20B investment for new data centers: CNBC

– *Trump: Interest rates are far too high

– *Trump reiterates he’ll reverse Biden offshore drilling ban

– *Trump: Something will have to be done with Canada, Mexico trade

– *Trump: Will change name of Gulf of Mexico to Gulf of America

– *Trump threatens Denmark with tariffs over Greenland

– *Trump refuses to rule out economic, military tools for Panama

– *Trump: I want to see debt ceiling extension

In the end, bonds sold off as yields surged, creating a significant divergence between equities and the rising 10-year yield.

This raises the question: How long can this divergence persist before the market corrects itself?

If it does, will equities head south, or will yields soften considerably?

Read More