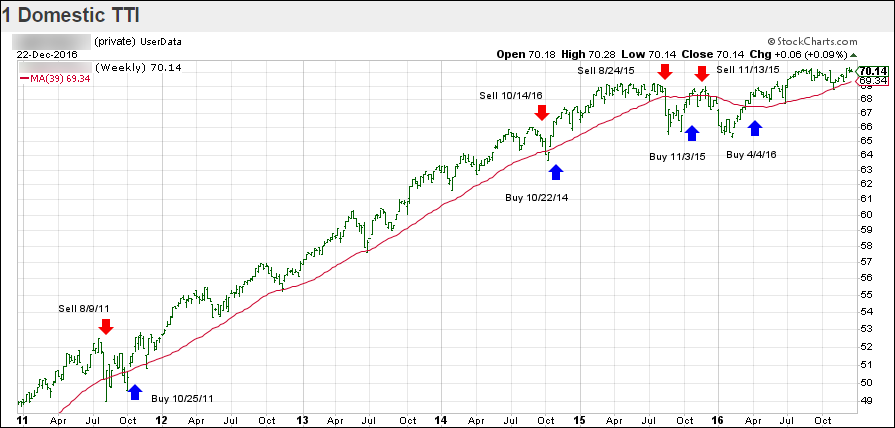

ETF Tracker StatSheet

https://theetfbully.com/2016/12/weekly-statsheet-for-the-etf-tracker-newsletter-updated-through-12222016/

Market Commentary

Wall Street Takes A Breather

[Chart courtesy of MarketWatch.com]

- Moving the Markets

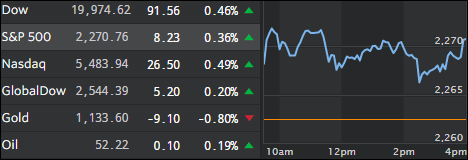

The major indexes moved in a tight trading range today and for most of the week with the S&P 500 adding 6 points over the past 5 trading sessions.

I found today’s two economic data points more confusing than clarifying:

There is an odd divergence in the latest UMichigan consumer sentiment print: on one hand, the December index of Consumer Sentiment rose from 93.8 in November to 98.2, up from the preliminary 98.0 print, even as long-term inflation expectation, those in the 5-10 year bucket, dropped from 2.50% to 2.30%,a new all time low print.

hich is odd, because the very reason for the surge in confidence is due to the recent spike in the market, driven higher by expectations or rising inflation, something which apparently has not filtered through to ordinary US consumers, who instead are hoping to have their Dow Jones 20,000 hat, while basking in the glow of dropping prices and a “deflationary mindset.”

And then this:

Soaring homebuilder confidence, crashing mortgage applications, spiking mortgage rates, weak pending home sales, strong existing home sales, and now new home sales for November surged 5.2% MoM (smashing expectation of a 2.1% rise). Take your pick of the US housing ‘recovery’ narrative.

The effect on the markets was non-existent with most traders having already left for the holiday leaving only the surprisingly subdued algos in charge.

Read More