- Moving the Markets

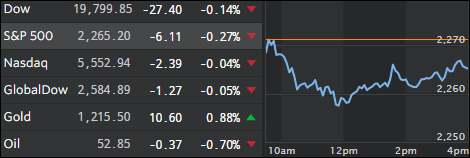

Today it was a battle between earnings and uncertainty over Trump’s pro-business agenda. At least for today, earnings won the battle, and the major indexes rode the positive momentum higher. The materials and financial sectors fared the best climbing 2.5% and 1.2% respectively.

With earnings season heating up, so far S&P profits are supposed to have risen some 6.7% in the last quarter which, if true, would make it the strongest growth in a couple of years. However, valuation-wise, we have moved towards lofty levels with the post-election rally, which was based on nothing but hope and promises. Given that, the S&P 500 is trading at about 17 times forward 12-month earnings, which is far above the 10-year median of 14.2.

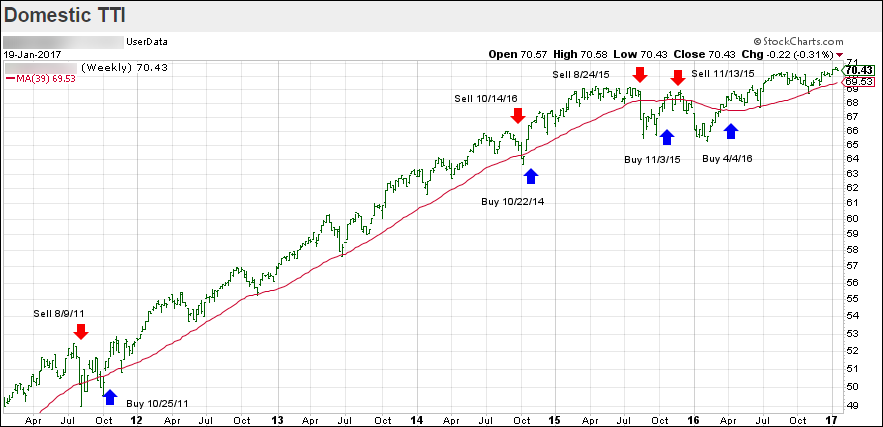

Then again, none of that matters, it’s up, up and away until one day you’ll hear this giant sucking sound when the air comes out of the bubble; it’s not a matter of “if” but “when.” In the meantime, we’ll stay the course and follow the major trend higher until it ends.