- Moving the Markets

The stagnated rally of the past few days, during which Wall Street was looking for more details about Trump’s agenda, was revived today when he stepped up to the plate and said that “he would make a major tax announcement in a few weeks.” He also added that “lowering the overall tax burden on American business is big league” without giving any further indication as to what this might entail.

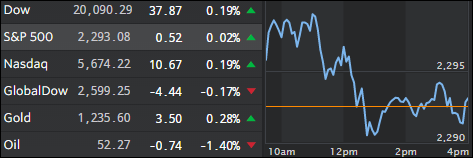

That’s all it took, and the major indexes scored a triple with all three of them gaining over +0.5% for the session. Financials performed the best by gaining +1.4% and were closely followed by energy with +0.9%, while the conservative utilities sector gave back -0.8%.

Trump’s announcement overrode even poor earnings news from Twitter (-12.3%), Intel (-2.5%) and Coca Cola (-1.8%). Bonds sold off as interest rates rose with the US-10 year yield gaining 6 basis points to 2.40%, as the 30-year bond yield spiked back above the 3% level to end at 3.02%.