- Moving the Markets

All eyes were on the Fed today, or more specifically Janet Yellen’s testimony before the U.S. senate banking committee. Among much jawboning Yellen warned that “waiting too long to remove accommodation would be unwise,” along with this bon mot that “at our upcoming meetings, the committee will evaluate whether employment and inflation are continuing to evolve in line with these expectations, in which case a further adjustment of the federal funds rate would likely be appropriate.” Isn’t the latter what they evaluate at every meeting?

As always, Yellen left the door wide open if three interest rate hikes would be warranted this year as they originally signaled last December. In other words, the direction of interest rates is as murky as ever. Nevertheless, the markets interpreted her speech as being hawkish (higher rates) and yields surged with the 10-year yield gaining 4 basis points to +2.47%. As a result, the widely held 20-year Treasury Bond ETF (TLT) lost -0.72%.

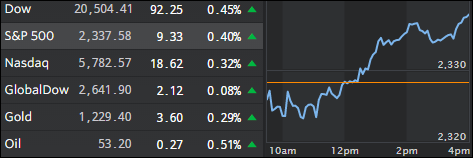

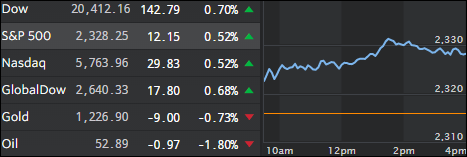

With higher rates, you would have expected equities to tank—but no—the rally continued with all major indexes gaining as the above table shows. Bank stocks and the dollar headed higher along with gold, which gained marginally. Right now, so it seems, we’re back to where any news is good news for stocks…