- Moving the Markets

Market nervousness and uncertainty prevailed as all eyes were feasted on the Fed ahead of their widely anticipated rate hike due to be announced tomorrow late morning. The longer term effect of such a hike remains subject to much speculation, as the Fed will be raising rates into a weakening economy with a GDP growth rate that is anything but awe inspiring.

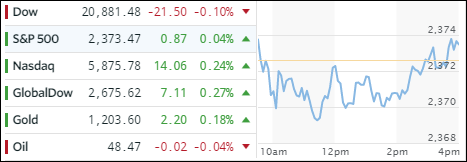

Equities dropped with all 3 major indexes pulling back as the chart above shows; even gold couldn’t defend its $1,200 level and closed slightly below it. Bonds rallied as the yield on the 10-year Treasury bond dropped by 2 basis points to 2.60%.

The social media darling Snapchat (SNAP) continued to get hammered, and has not only surrendered its IPO rally, but closed deeply in the red below its IPO price. The canary in the coal mine, AKA the high yield corporate bond ETF (HYG), has been falling off a cliff and has broken its 200 day MA to the downside, the first time since Trump’s Election Day. Not a good sign for equities, since they tend to track high yield.

Take a look at the chart: