Eidus Martiae is the Latin term for 15th March, from the traditional Roman calendar. Since 44 BC, the Ides of March has held a dark reputation, as that was coincidentally the date of the assassination of Julius Caesar.

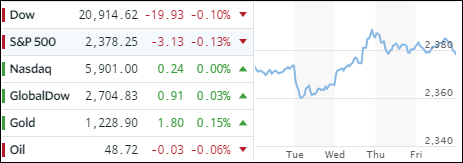

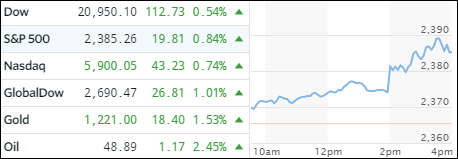

In December of 2016, the Chairman of the Federal Reserve announced that the Fed was likely to raise the interest rate several times in 2017. The next such rise is anticipated to take place on 15 th March.

This is also an interesting date, as it’s the date upon which the US government reaches its debt ceiling. This was cast in stone by the previous administration, back in 2015. Although they put into place an automatic freeze on any increase in debt after that date, they did nothing to either cut back on expenditure or prepare for further funding. Therefore, the Ides of March once again has become ominous, as the US government is set to come to a grinding halt as soon as the money presently in the Treasury runs out.