ETF Tracker StatSheet

You can view the latest version here.

GOLD SHINES AMID MARKET TURMOIL, BITCOIN STUMBLES ON CHINA NEWS

- Moving the market

A weak consumer sentiment reading and a nearly 9% drop in UnitedHealth stock combined to dampen any bullish sentiment, causing major indexes to dive early on.

According to the Wall Street Journal, UnitedHealth is under investigation by the Justice Department, with more information to come. This pullback marks the stock’s worst decline in five years. However, a comeback may be on the horizon after the company labeled the WSJ’s report on Medicare billing practices as “misinformation.”

The Michigan consumer sentiment index fell to 64.7 in January, plunging into contraction territory, which represents a 10% drop and was worse than expected due to fears of higher inflation ahead.

Additionally, January U.S. existing home sales declined by 4.9% month-over-month, compared to expectations of a 2.6% drop, as mortgage rates rose. Sales fell the most in the West and South, partly due to destructive wildfires and severe winter weather.

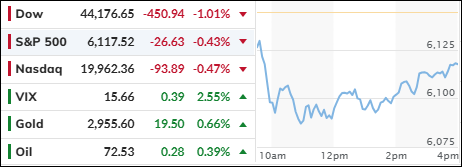

With markets struggling all week and entering the seasonally weakest period of the year, traders are increasingly concerned with the soft data points, as indexes slump despite the S&P’s recent all-time high.

In the end, nothing worked for the bulls. Multi-trillion-dollar options expirations, China’s discovery of a new coronavirus, and the upcoming elections in Germany this weekend all contributed to major indexes closing lower for the week.

These factors pulled down the U.S. Macro Surprise Index, which neared six-month lows, with the much-feared “stagflation” premise reappearing. The most shorted stocks were slammed to five-week lows, while the mega-tech sector retreated to its recent trading range. Bond yields headed lower as rate-cut expectations rebounded from their recent sell-off.

Gold remained the unshakable asset class, closing higher for the eighth straight week while scoring a new record high. The dollar lost momentum and dropped, while Bitcoin suffered a similar fate, crossing $99k to the upside before the China news pulled the rug out from early bullish sentiment.

As Zero Hedge pointed out, Bitcoin follows global liquidity and may have more downside momentum left before racing back into record territory.

Read More