ETF Tracker StatSheet

https://theetfbully.com/2017/07/weekly-statsheet-etf-tracker-newsletter-updated-07062017/

ROLLER-COASTER WEEK ENDS ON A POSITIVE NOTE

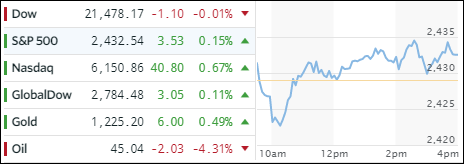

[Chart courtesy of MarketWatch.com]

- Moving the Markets

A roller-coaster week ended on the plus side with the S&P 500 squeezing out a 2 point gain after recovering from yesterday’s sell off. A better than expected jobs number supported equities with the employment report showing that 222,000 jobs (vs. 179k expected) were added in June. The unemployment rate ticked up to 4.4% from 4.3%.

While the number made a good headline and sparked bullish optimism, the devil was in the details. While it helped that April and May payrolls were revised upward, and added +47,000 more than reported it also may validate the Fed’s hawkish bias, meaning more rate hikes may be forthcoming in the future, an outcome which will affect equities negatively at some point.

Also, wage growth disappointed with a hike in average hourly earnings of only +0.2%, while the number was revised lower for May from +0.2% to +0.1%. So, where were most of the jobs generated? Health care took the lead with +37,000, which was closely followed by business and professional services (+35,000). The third place was occupied by low end food services and drinking places (+29,000) confirming that the waitress and bartender jobs are continuing their trend higher having generated 277,000 positions over the year.

Interest rates continued their upward trajectory with the 10-year bond yield rising by 2 basis points to 2.39%, its highest spot since early May. The Dollar index, as represented by UUP, managed to bounce +0.16% after having dropped 2 straight days. Oil slipped -2.59% while gold had a bad week and dropped to March lows.

Read More