- Moving the Markets

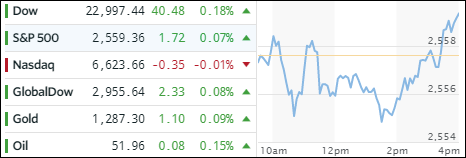

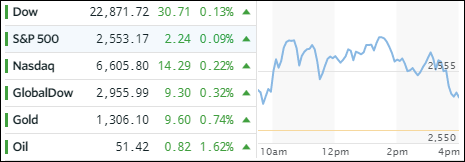

While the Dow managed to eclipse the 23k milestone marker intra-day, it was not able to hold this level into the close by falling 3 points short. Nevertheless, the record is in the books with the Dow notching its 4th 1,000 point climb in the past 12 months—the most ever in a calendar year.

Unbridled optimism about Trump’s tax plan remains the main focus, despite absolutely no assurances that it will have the support to be implemented and actually executed. But those appear to be minor details also brushed aside by an alleged improving economic outlook along with positive corporate earnings.

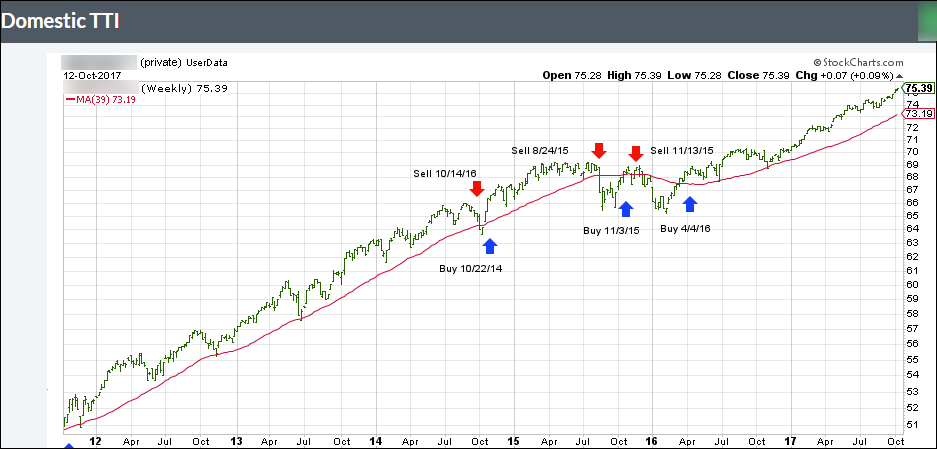

Be that as it may, the major trend continues to be up, and we will stay on board until that fact changes. Despite the Dow’s glitter, the actual performance of the major indexes was mixed at best. In ETF space, the gains were sparse with only the Dividend ETF (SCHD) and LargeCaps (SCHX) adding +0.4% and 0.3% respectively. On the downside, Emerging Markets (SCHE) took the lead with -0.47% followed by Transportations (IYT) with -0.37%.

Gold took a dive and surrendered not just -1.22% but also gave back its $1,300 marker. Interest rates were mixed but the 20-year bond (TLT) managed to eke out a +0.13% gain. The US dollar (UUP) round tripped by rallying sharply at first and then giving back most of its gains, but it still managed to end the session up +0.25%.