- Moving the Markets

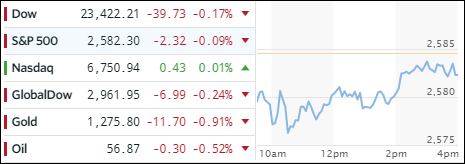

The major indexes dropped into the red right after the opening bell but managed to climb out of the basement fairly quickly only to spend the rest of the session around the unchanged line without much conviction. In the end, we closed in the green but only by the slightest of margins.

Upside momentum never shifted into high gear as worries about more delays in the timing of the corporate tax cuts kept a lid on any meaningful advances. The differences in the House’s and Senate’s versions appear to be so large that a quick resolution appears unlikely—at least as of this very moment.

In ETF space, we saw more winners than losers. On the plus side, Semiconductors (SMH) ruled with a gain of +0.42% with the Dividend ETF (SCHD) following closely behind with an advance of +0.39%. On the negative side, International SmallCaps (SCHF) gave back -0.72% while Aerospace & Defense (ITA) lost -0.51%.

Interest rates were mixed and traded in a tight range with 10-year bond yield remaining unchanged by clinging to the 2.40% level. Even the High Yield ETF (HYG) stopped its free-fall for the moment by only dropping -0.07%. The US dollar (UUP) appeared to be trend-less as well and closed up +0.08%.