- Moving the market

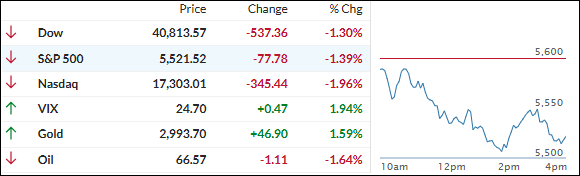

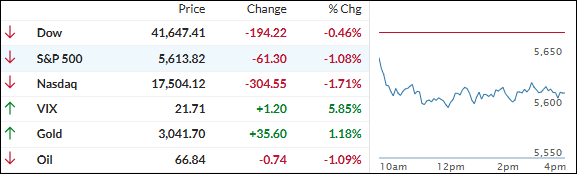

The two-day comeback rally hit a brick wall today, with the major indexes retreating, led by the Nasdaq.

Tesla was one of the hardest-hit stocks, falling over 5% after an analyst lowered its price target due to rising competition in the EV space. The company’s stock has declined about 36% over the past month.

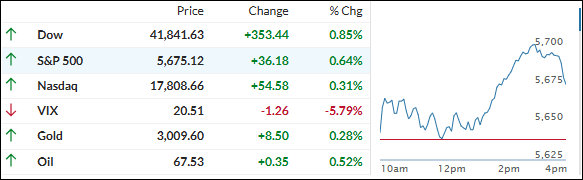

The S&P 500 officially entered correction territory last week, dropping 10% from its recent high. It now sits on the cusp of either breaking out to the upside or breaking down further. The three major indexes are down year-to-date and have been outperformed by gold, which has gained almost 15% over the same period.

Traders are anxiously observing the Fed’s two-day policy meeting, which concludes tomorrow afternoon with a press conference. Current odds are 99% that the central bank will hold rates steady, despite wishful thinking on Wall Street that the recent “growth scare” might sway the Fed to lower rates.

Offsetting that scare somewhat were positive housing starts and record-high industrial production, though rising import prices have dampened expectations for a rate cut. Big tech stocks took a dive today, bond yields were mixed, and the dollar swung wildly before ending only modestly lower.

Gold continued its strong performance, advancing deeper into the $3,000 territory, while Bitcoin lost its footing and fell back to the $81,000 level.

All eyes are now on the Fed’s announcement on interest rates tomorrow, but traders will be closely analyzing Fed Chair Powell’s commentary to determine if we are facing a “risk on” or “risk off” scenario moving forward.

Read More